The 180-day lockup period for LexinFintech Holdings (LX) ends on June 19, 2018. When this six-month period ends, the company’s pre-IPO shareholders will have the opportunity to sell currently restricted shares. Just 7.3% of LX shares outstanding are currently trading pursuant to the IPO.

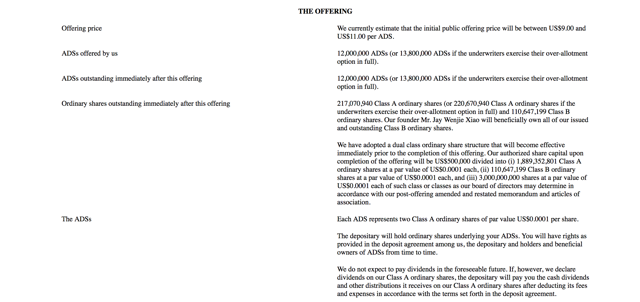

(Click on image to enlarge)

(Source: S-1/A)

The potential for a sudden increase in the volume of shares traded on the secondary market could negatively impact the stock price of LexinFintech.

Currently, LX trades in the $15 to $16. Shares of LexinFintech had a first-day return of 18.9%. The shares reached a high of $19.09 on March 9, and then dropped to a low of $12.03 on April 6. The shares recovered in price, and LX has a return from IPO of 77.1%.

Business Overview: Online Consumer Financial Products Platform in China

LexinFintech Holdings offers consumer financial products online through its platform in the People’s Republic of China. It operates its online consumer financial platform known as Fenqile, which offers installment purchase loans, personal installment loans, and other loan products. In addition, the company offers its Le Card credit line. It pairs consumer loans with a range of diversified funding sources such as individual investors over its Juzi Licai electronic investment platform and institution partners through direct lending programs.

(Click on image to enlarge)

(Source: S-1/A)

Through September 2017, LexinFintech had approximately 6.5 million active consumers with approved credit lines. They also had more than 20 million registered users. The company focuses on young, well educated adults between the ages of 18 and 36. This consumer base in China has high income potential, high consumption needs, high education backgrounds, and a desire to build a strong credit profile. Through September 2017, this consumer group comprised more than 90% of LexinFintech’s customer base.

Since its inception, the company has cumulatively originated $9.0 billion in loans. For the nine months through September 30, 2017, LexinFintech originated $4.7 billion in loans for an increase of 124% over the same period the prior year.