Technical, Fundamental Market Drivers And Lessons For The Coming Week And Beyond From The US, Europe, Japan & China, For Traders & Investors in Stocks, Forex, Commodities, and Other Global Markets

The following is a partial summary of the conclusions from the fxempire.com  fxempire.com ’ meeting in which we cover the key lessons learned for the coming week and beyond.

Summary

-Technical Outlook: Mixed

-Fundamental Drivers: Overview of what’s need to sustain global bull market

-US: Earnings metrics, Fed policy

-State Of Likely Crisis Flashpoints: EU, Japan, China

TECHNICAL OUTLOOK

First we look at overall risk appetite as portrayed by our sample of global indexes, because the EURUSD has been tracking these fairly well recently.

Overall Risk Appetite: Sample Global Weekly Chart & Key Take-Aways

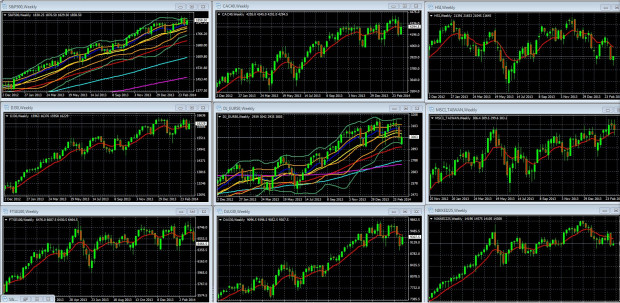

Our sample of weekly charts for leading global stock indexes suggests a mixed technical picture, with the US locked in a tight 5 week trading range but retaining its upward momentum, while Europe and Asia have pulled back in recent weeks under the combined weight of the Crimean situation and China slowdown fears exacerbated by what’s becoming weekly corporate bond defaults and weak data.

Weekly Charts Of Large Cap Global Indexes With 10 Week/200 Day EMA In Red: LEFT COLUMN TOP TO BOTTOM: S&P 500, DJ 30, FTSE 100, MIDDLE: CAC 40, DJ EUR 50, DAX 30, RIGHT: HANG SENG, MSCI TAIWAN, NIKKEI 225

KEY: 10 Week EMA Dark Blue, 20 WEEK EMA Yellow, 50 WEEK EMA Red, 100 WEEK EMA Light Blue, 200 WEEK EMA Violet, DOUBLE BOLLINGER BANDS: Normal 2 Standard Deviations Green, 1 Standard Deviation Orange

Source: MetaQuotes Software Corp, www.fxempire.com, www.thesensibleguidetoforex.com

01 Mar. 22 20.49

Fundamental Drivers

1-3. Goldman Sachs’ David Kostin predicts 1,900 year-end close for the S&P 500, which reflects a modest 3% gain from current levels. For that target to rise, Kostin says 3 things must increase further:

1-Â Â Â Â Â Profits

2-Â Â Â Â Â The expected forward earnings growth rate, and/or

3-Â Â Â Â Â The P/E multiple that investors will accept

Said Kostin: “Given the high starting point of all three metrics, it is hard to identify any one of these that will climb significantly during the coming year.†See here for details.

We’ll know more about these in the coming weeks with the start of Q1 2014 earnings announcements. Alcoa’s (AA) on April 8th marks the official start of earnings season.

4-5. We’d add to that list:

4-     Belief that there will be continued low interest rate: Maybe yes, maybe not, but if not, we’re in trouble. Remember that one of the two pillars of the rally since 2009 have been continued easy monetary policy (stimulus & low rates). Even if the US tightening is gradual enough to avoid damage (?), China is also tightening as part of its own reforms. We’ll have more on that below. The other pillar has been….

5-Â Â Â Â Â No crises in any of the major economic zones. The EU may be most at risk, but there are real concerns about Japan and China, as detailed below.

Â

None of these supports can be assumed to continue.

Let’s look at each of them.

4. Are US Rate Hikes Really Coming Soon?

That’s a good question. Even if Janet Yellen actually meant that the fed intends to begin rate hikes in mid-2015 (we read assorted comments from Fed and non-fed sources suggesting otherwise) the Fed is clearly improvising as it goes.