You might be asking why would I chart an index and why this particular one. Well I really believe that the whole is equal to the sum of its parts. Most of the other indices are market weighted which I think skews the index if it contains large cap stocks. The Value Line Arithmetic Index ($VLA) contains about 1700 stocks, which covers over 95% of the entire US stock market capitalization but weights each stock equally.

If you believe like I do that there is a time to be fully invested and a time to be accumulating some cash then you should follow the Index like you’d follow a stock. I’m accumulating stocks the the Index has positive technical indicators and accumulating cash when the Index’s technical indicators are negative.

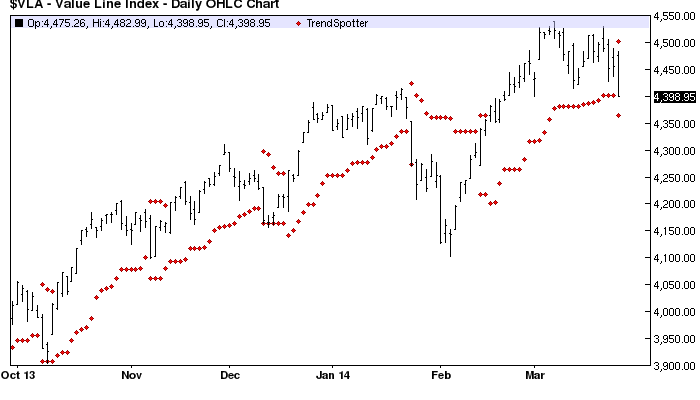

Let’s see where we are today.

Barchart’s Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

- 0% Barchart technical buy signals

- Trend Spotter hold signal

- Below its 20 day moving average but above its 50 and 100 day moving averages

- 5 new highs this month but down .87% for the month

- Relative Strength Index 44.12%

- Barchart computes a technical; support level at 4,342.93

- Recently computed at 4,398.95 with a 50 day moving average of 4,379.83

By looking at the Index you can see that earlier in the week there was still a Trend Spotter buy so any stocks I sold were replaced but today the Trend Spotter crossed and signaled a hold so I won’t replace any stocks I sell until I see positive momentum from the Index. I always try to be on the right side of the market.