Ezcorp (EZPW) is an excellent play on the American consumer with a recession proof business and a skilled management team, according to Laughing Water Capital.

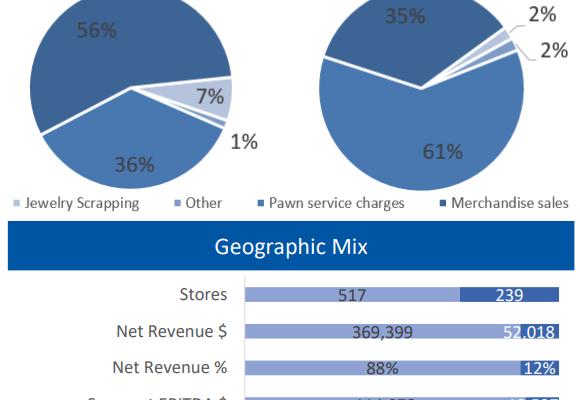

At last month’s Valuex Vail conference, Laughing Water presented Ezcorp as its top stock pick. The presentation makes a compelling argument for the second largest publicly traded pawn company in the US. The past few years have been difficult for the company; previous management made some mistakes that the current management has had to undo. This year is the third year of a three-year plan designed to refocus the business, sell off non-core assets and write off any unproductive divisions.

Even though shares in the company up around 300% since the beginning of 2016, Laughing Water believes there is further growth ahead as the company focuses on its new streamlined business and grows through acquisitions.

Ezcorp: Management incentivesÂ

Management is highly incentivized to make the business the best it possibly can be. The new CEO, Stuart Grimshaw, left his job at the third largest bank in Australia to join the firm and the top 20 executives have been awarded compensation plans based on a net gearing of 20% and EBITDA growth of 80% over three years (a new target is expected in September 2017). Together management and the company’s controlling shareholder own around 8.2% of the business.

The second and third stages of the company’s three-year plan involve improving margins, loan growth, and cutting costs. A new system has changed store level incentives, and managers are rewarded for increasing store level profitability.

Meanwhile, corporate level expenses, which have historically been an area of pain for shareholders, are targeted at $50 million for 2018, down from $68 million in 2016. At the store level, management has downgraded the position of assistant managers and restructured pay awards to be more aligned with profitability. As the company improves its operating performance, there is enormous potential for growth.