The rumored “death of the shopping mall†is not only wreaking havoc among retail stocks, but it is also dragging down REITs that own retail properties. Take, for example, Kimco Realty (KIM). Shares of Kimco have declined 25% so far in 2017. The stock is sitting at lows not seen in the past five years.

The biggest reason for the decline is that investors are concerned about the ripple-effects of the decline of brick-and-mortar retailers eventually spreading to the REITs that own the real estate. However, Kimco’s fundamentals have held up so far this year. The prolonged decline in the share price has pushed up Kimco’s dividend yield to 5.7% Kimco is one of 295 stocks with a 5%+ dividend yield.

You can see the full list of established 5%+ yielding stocks by clicking here.

This article will discuss why investors should not assume Kimco will suffer alongside the retail industry. If anything, its huge share price decline presents a compelling buying opportunity for income investors.

Business Overview

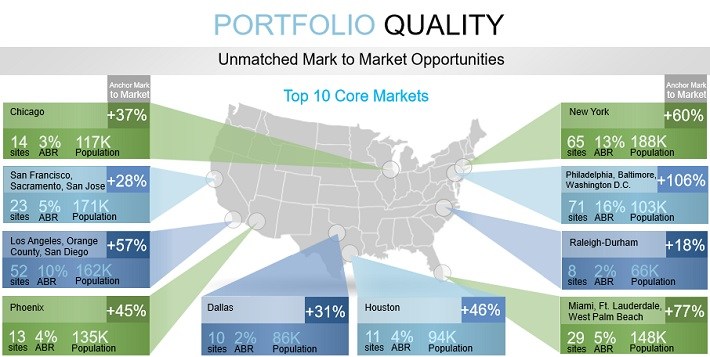

Kimco is one of the largest REITs focusing on shopping centers. At the end of the first quarter, it owned 517 U.S. shopping centers, spread across 34 U.S. states and Puerto Rico. Kimco’s properties are concentrated in high-density markets with high incomes. These are predominantly areas where store traffic is still strong.

Source:Â Q1 Earnings Presentation, page 20

Kimco’s top 10 core markets comprise approximately 80% of its annual base rent. This is a very difficult time for retailers, which means REITs that predominantly own retail space could be in big trouble. Indeed, if brick-and-mortar retail is truly dead, mounting store closures and bankruptcies will inevitably impact retail industry REITs like Kimco.

A quick scan of Kimco’s tenants is admittedly terrifying: Sears Holdings (SHLD), Kmart, and J.C. Penney (JCP) to name a few. Fortunately, Kimco has only been minimally affected, because many of the stores being closed are company-owned.