Kimco appeared in a screen I wrote about in a 7/5/18 blog post that searched for high-yielding good-quality REITs. At first glance, I liked Kimco but when I looked under the hood of its distributions, my like turned to hate, so much so, I’m going to revise the screen to make sure  REITs like Kimco are excluded.

First Thing Frist

I don’t hate that Kimco is a retail REIT. Specifically, it owns local open-air shopping centers with merchants-tenants geared toward convenience, services and omnichannel retailing. Yes, there’s been a ton of hand-wringing about Amazon and the e-commerce apocalypse it unleashed on brick and mortar retailing, and there are, indeed, a lot of merchants that are being badly hurt. I get all that. But what we actually have is disruption, not destruction. The latter means everybody is doomed. The former means change and that those who adapt will be fine, and those who don’t will not.Â

For more on my views regarding the type of retailing Kimco caters to, and the merits of investing in it via the REIT vehicle, see my recent post on Brixmor (BRX). In fact, my initial draft of that post wasn’t just for Brixmor; I initially wrote about both Brixmor and Kimco and adopted bullish stances on both. Kimco’s cash on cash returns (my REIT-oriented version of an important real estate metric) wasn’t nearly as strong as those of Brixmor, but it was just passable under my screen, and Kimco’s use of debt was less aggressive than the case with Brixmor. And Kimco had a higher yield . . .  sort of . . .

REIT Yields Can Be Tricky

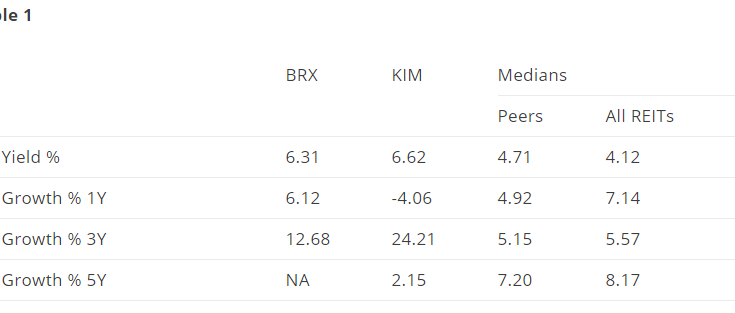

Table 1, which I intended to use in the BRX-KIM post, shows how easily REIT investors can go astray when it comes to yield.

(Click on image to enlarge)

Data from S&P Compustat via Portfolio123.com and reflects Compustat standardization protocols, TTM = Trailing 12 Months, MRQ = Most Recent Quarter. The Peer group refers to Retail REITs.

KIn the second row of the Table, Kimco shows a reduction in the dividend in 2017. Say what!!!!!

Most sources, including the Kimco Investor Relations website, paint a different and much more favorable picture. There could be a data error, as many might be quick to assume, but data collection and distribution is pretty sophisticated nowadays, and that drove me to dig. When something doesn’t look quite right, I double check myself, often aggressively, before writing up a  support ticket at the data provider.