Data/Event Risks

Data/Event Risks

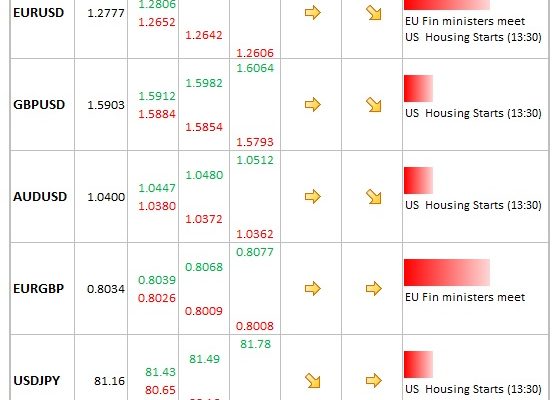

- USD: Housing Starts data not a major event risk, but stronger data (as seen with yesterday’s housing data) could support better tone to risk.

- EUR: Finance ministers meet on Greece deciding on next bailout payment and further short-fall in funding from relaxation of last week’s targets. Risk for late session volatility, especially given divisions with the IMF.

Idea of the Day

The euro was buoyed into the close yesterday on reports that today’s meeting was likely to lead to loan disbursement for Greece (although then hit by France downgrade overnight). More importantly is how the shortfall from the extension of the deficit target last week (over EUR 30bn) is going to be covered. This is where the cracks emerged with the IMF, which thinks that the public sector (including the ECB) has got to take a hit on its substantial exposure to Greece. By piling on more debt, EU leaders are effectively throwing bricks at a drowning man, which is why the Greek economy is sagging ever deeper into depression. As always, the short-term fix is not the longer-term solution.

Latest FX News

- EUR: Lower early Asia on Moody’s downgrade of France, from top rating of Aaa to Aa1 with negative outlook maintained. EUR was squeezed higher late in the European session, on combination of short-covering and positive headlines on further loan payment to Greece.

- USD: Modestly softer through Monday on the back of more positive sentiment towards fiscal cliff resolution, with this also providing support for equities (S&P up 2%).

- JPY: No surprise to see the Bank of Japan holding fire on further stimulus measures following its policy meeting. Some modest yen short-covering but holding tight to yesterday’s range. BoJ governor pushing back against pressure from opposition leader Abe.

- GBP: Greater focus this week on strains within the EU as UK PM Cameron refuses to sign off on the latest budget plan. Sterling not moved on news, but worth keeping an eye on.

- AUD: RBA minutes showed the central bank keeping hopes of easing alive, but AUD largely unmoved. Note that IMF is looking at classifying both AUD and CAD as reserve currencies. This would mean we get more detailed data on central bank holdings in the future.