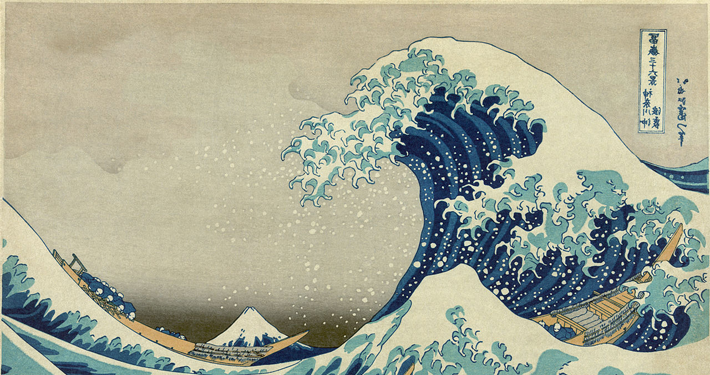

With a huge demographic tidal wave upon us – one which has been called a silver tsunami – you would think that Ventas (NYSE: VTR) shareholders would have nothing to worry about when it comes to getting paid their dividends. After all, 10,000 people per day are turning 65 in the United States. And we know that as we get older, we need more healthcare.

Ventas has a portfolio of more than 1,300 senior housing and healthcare facilities in the U.S., U.K. and Canada. Ventas is a real estate investment trust (REIT) with an attractive 5.5% yield.

But is it safe?

Ventas has raised its dividend for each of the past five years, boosting it by a compound annual growth rate of 7.7% per year. It hasn’t cut its dividend in over 10 years. The last one occurred in 2002.

While I love a good track record of stable and rising dividends, I have to make sure the fundamentals can support the dividend, otherwise yellow or red flags come up. When that happens, we can get out of a stock way before the dividend is cut.

Healthy Numbers

Funds from operations (FFO), which is a measure of cash flow used by REITs, is projected to grow 6.5% this year, but slow down to a growth rate of 1.3% next year.

In 2014, Ventas’ FFO per share was $4.29. It paid out $2.97 per share in dividends for a payout ratio of 69%. The payout ratio is the percentage of cash flow that is paid out in dividends. Most of Wall Street uses earnings instead of cash flow for the payout ratio figure, but cash flow is a more accurate barometer because dividends are paid with cash, not earnings.

There is a difference.

Earnings contain all kinds of noncash items, like stock-based compensation and depreciation, which have no bearing on the amount of cash that is generated by the company’s operations.

Generally speaking, I like to see a payout ratio of 75% or less. That gives me confidence that the dividend will be sustained even if the company has a rough year or two where cash flow declines.