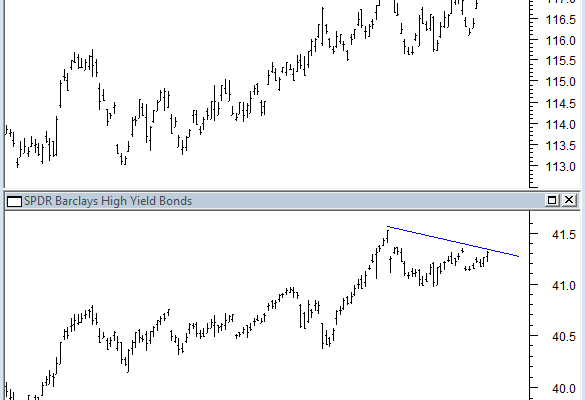

Over the past month High Yield (junk) bonds (JNK) have lagged the performance of Investment Grade (high quality) bonds (LQD). This shows a move to quality within the bond space. In addition, money that came out of stocks during the last dip went into quality bonds instead of high yield. Bulls want to see JNK recover their previous highs.  As neither a bull nor a bear, but a guy who changes my portfolio allocations based on the evidence I’m keeping an eye on JNK vs. LQD.  If the divergence continues it will warn of investors slowly moving away from risk.