It is not often that I have had the pleasure of reading and reviewing two Sense on Cents instant classics in the course of just a few days but today I am excited to bring you another absolute MUST READ.

It is not often that I have had the pleasure of reading and reviewing two Sense on Cents instant classics in the course of just a few days but today I am excited to bring you another absolute MUST READ.

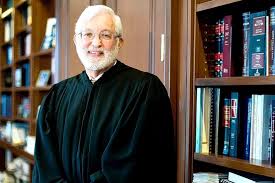

None other than Judge Jed Rakoff, who has heard many of the major financial suits brought over the course of the last few years, spoke the other day to the New York City Bar Association regarding the question so many in our nation still ask, “Why have no high level executives been prosecuted in connection with the financial crisis?â€

In what might have been a fabulous foreword to my upcoming book, Rakoff skillfully delivers what I believe is an incredibly excoriating indictment of those within the Department of Justice,the SEC, and elsewhere.

. . . if, by contrast, the Great Recession was in material part the product of intentional fraud, the failure to prosecute those responsible must be judged one of the more egregious failures of the criminal justice system in many years.

Indeed, it would stand in striking contrast to the increased success that federal prosecutors have had over the past 50 years or so in bringing to justice even the highest level figures who orchestrated mammoth frauds.

That’s right. Rakoff is just warming up. He proceeds by inquiring that perhaps no actual fraud was committed; however, he disarms that premise in stating,

. . . the stated opinion of those government entities asked to examine the financial crisis overall is not that no fraud was committed. Quite the contrary.

For example, the Financial Crisis Inquiry Commission, in its final report, uses variants of the word “fraud†no fewer than 157 times in describing what led to the crisis, concluding that there was a “systemic breakdown,†not just in accountability, but also in ethical behavior.

As the Commission found, the signs of fraud were everywhere to be seen, with the number of reports of suspected mortgage fraud rising 20-fold between 1998 and 2005 and then doubling again in the next four years.