JPMorgan officially launched Q3 earnings season with earnings that were generally inline including a solid beat on earnings, despite an unexpected miss in FICC sales and trading and Investment banking, coupled with weakness in home lending as a result of sliding mortgage refi activity.

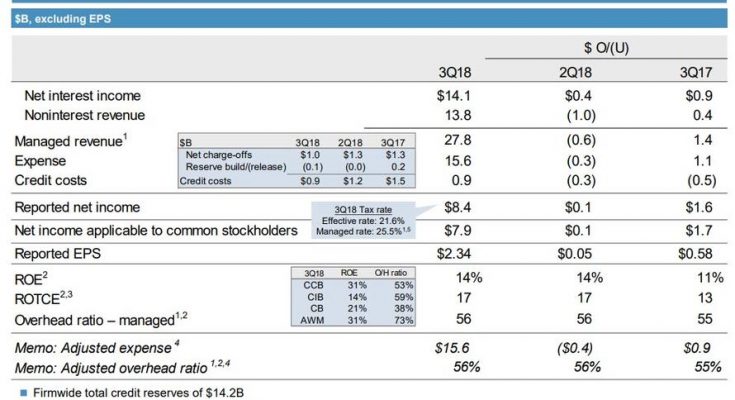

JPM reported total managed revenue of $27.8BN (the sum of $14.1BN in net interest income and $13.8BN in non-interest revenue), above the $27.44BN estimate, resulting in $8.4BN in net income, a 24% increase Y/Y, translating in $2.34EPS, higher than the consensus estimate of $2.25. The number included net charge offs of $1 billion, offset by a $0.1BN reserve release, resulting in total credit costs of $0.9BN.

Â

Commenting on the results, Jamie Dimon was his usual optimistic self: “the U.S. and the global economy continue to show strength, despite increasing economic and geopolitical uncertainties, which at some point in the future may have negative effects on the economy.”

Something else: as Bloomberg’s Max Abelson notes, “when I re-read Dimon’s comments this morning, I’m struck by just how much he seems to be trying to flatter Donald Trump.”

Not only does Dimon cite “smart regulatory policy” (a euphemism, in part, for a friendlier White House) and “a competitive corporate tax system” (lower taxes for big companies), he even touts the bank’s first branch in Washington. In other words, he’s still backtracking from his notorious Trump insult a few weeks ago. I’m wondering if he had a nudge from his board?

Helping the bottom line was JPM’s effective tax rate of only 21.6%, down sharply from 29.6% a year ago, which may explain why Jamie Dimon gave a shout out to corporate tax changes: “We are extremely excited to be expanding again, as smart regulatory policy and a competitive corporate tax system help us to deliver on our commitment to invest in our customers and communities.