There were four things we mostly cared about in today’s JPM earnings release, the first Wall Street bank to report Q4 results:

- how did the company’s fixed income and equity trading revenue do;

- what is the bank’s credit exposure to energy/oil;

- did the recent Fed hike do anything to boost the company’s Net Interest Margin (this has been the primary catalyst for bank share upside), and

- did JPM halt its practice of releasing reserves and start building reserves – a major inflection point when it comes to management expectations for future credit quality deterioration.

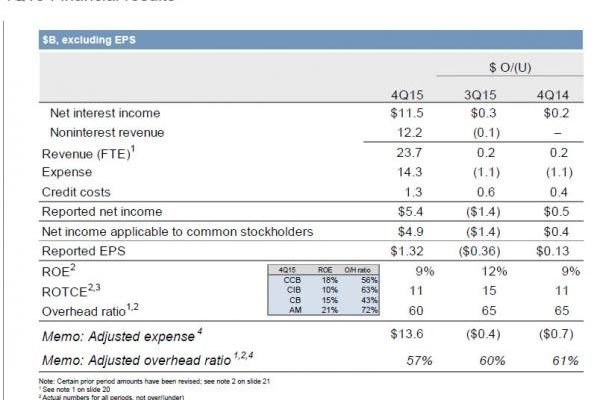

But before we go there, here is a quick skim of the summary income statement: as the table below shows, JPM posted a modest $0.13 increase to EPS Y/Y which rose to $1.32, beating estimates of $1.27 driven by a $1.1BN reduction in expenses while revenue increased only $0.2BN from a year ago. One place where the cost-cutting may have come from is headcount as JPM lost 12,000 workers in 2015 and has lost ~43,000 since 2012. However, the biggest hit was in Investment Banking compensation (as in bonus accruals) which dropped by $1.1BN Y/Y to $4.4BN, also down $1.7 billion from the prior quarter. It will not be a happy year for JPM bonus recipients.

Â

Then a quick look at JPM’s balance sheet which has continued its recent trend of declining, and was down to $2.352 trillion, down $221 billion from a year ago, while the matching decline on the liability side was once again in deposits which dropped to $1.28 trillion from $1.363 trillion a year ago, while non-operating deposits decline by $200 billion. And while JPM no longer discloses the full breakdown of its Net Interest Margin, it did note that “Firm NII up $310mm QoQ and NIM up 7bps QoQ to 2.23%”, adding to “Expect 1Q16 Firmwide NII and NIM to be flat to slightly up sequentially.” One would sure hope it is up instead of flat: after all that was the whole point of the Fed rate hike right.