Dancing While the Music Plays: “You Will Have No Choice But to Buyâ€

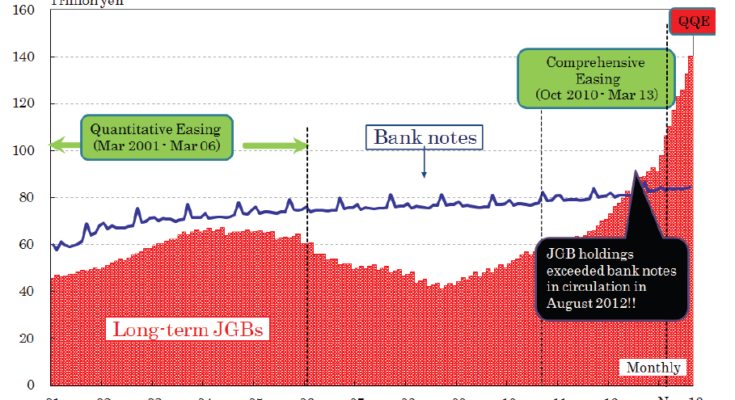

In mid April, Reuters reported that there hadn’t been any trades in 10 year JGBs for a day and a half – shortly after the BoJs holdings of JGBs topped 200 trillion yen for the first time. There once used to be a limit to ‘QE’ by the BoJ: it wasn’t allowed to buy long term JGBs in excess of the amount of yen bank notes in circulation. This rule, which was introduced in 2001, was repealed ‘temporarily’ with the beginning of Kuroda’s massive ‘QE’ operation, although it had already been broken almost a year earlier. Considering that Japan’s bank notes in circulation amount to about 80 trillion yen, the limit has by now obviously been left completely in the dust. In fact, since 1999, the BoJ has gradually repealed all the ‘JGB purchase rules’ that were put in place in 1967. Once it couldn’t buy a government bond until one year after its issuance for instance, and only 20 issues of 10 and 20 year bonds were eligible. By now, all bonds are eligible, and the ‘one year rule’ no longer applies. By the end of 2013, the BoJ’s long term JGB holdings amounted to 1.5 times bank notes in circulation:

BoJ’s long term JGB holdings vs. bank notes in circulation – click to enlarge.

Here are a few excerpts from the Reuters article mentioned above. We find the comments about the paucity of choices allegedly faced by market participants especially interesting:

“The Bank of Japan’s massive purchases of government debt hit a milestone this week, sucking liquidity out of the market to such an extent that the benchmark 10-year bond went untraded for more than a day, the first time in 13 years.

Data from the BOJ late on Monday showed its holding of Japanese government bonds topped 200 trillion yen ($1.96 trillion), or about 20 percent of outstanding issuance – up by more than half from 125 trillion yen about a year ago.

The fall in market liquidity looks set to intensify as the BOJ has vowed to continue its aggressive buying for at least another year, with market players expecting it to expand its easing some time later this year.

“Everybody thinks the market is not going to move for the time being because of the purchase by our dear customer, the BOJ,” said a trader at a major Japanese brokerage.

The BOJ stepped up its bond buying last April when Haruhiko Kuroda became its governor, vowing to take radical easing steps to end deflation once and for all. The increasing dominance of the BOJ in the market, however, resulted in shortage of tradable bonds in the market, reducing trading flows between market players. Brokers are reluctant to go short, fearing that they cannot buy back when they want. On the other hand, few investors are willing to chase prices higher, when the 10-year bonds yield about 0.6 percent

The upshot was that the average daily trading band of 10-year JGB futures price so far this month is 0.15, compared to about 0.50 in the 10-year U.S. Treasury notes futures. The current 10-year cash bonds saw its first trade of the week on Tuesday afternoon, having gone untraded for more than a day and a half. Trade volume in the benchmark cash bonds so far this month dropped to less than one trillion yen, down about 70 percent from the same period last year.

[…]

“Everybody is holding off buying now only because they want to buy at a higher yield. But in the end, the only strategy you can take under an environment like this is buy more given the shortage of what you can buy,” said Takeo Okuhara, fund manager at Daiwa SB Investments.

One reason many investors are cautious about buying despite tight market conditions is the trauma of sharp reversal in the market rally after the BOJ adopted the current policy last April. The 10-year JGB yield hit a record low of 0.315 percent on the following day after the BOJ’s easing, only to jump back to 1.0 percent about a month later — a scenario market players think can be repeated, given the fall in liquidity.

“I know this could end badly. But if you are in this market, you will have no choice but to buy,” Daiwa SB’s Okuhara said.â€