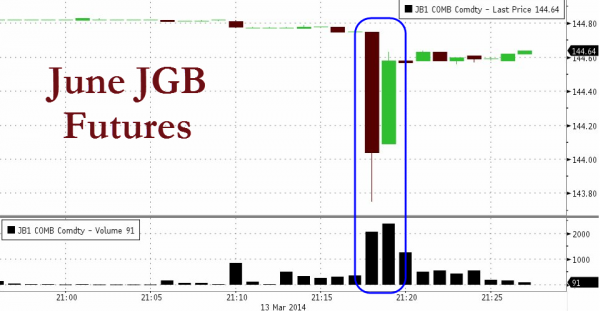

With all eyes focused on China (which is quiet for now), Japanese bond futures just collapsed over a point on very heavy volume only to be instantly lifted back to a modest loss in what appears to be a flash-crash – rather than a fat-finger (jamming June JGBs down to 2-month low prices). Gold, meanwhile, is continuing its day-session rally and has topped $1370 – it’s highest since September 19th. US equities are holding gains for now as JPY is bid (i.e. JPY crosses are tumbling).

JGBs flash-crash…

The ticks make it look like algos and not a giant fat-finger trade (and we note it occurred during BoJ’s JOMO time too)…

We wonder if it’s related to the force-feeding that the government recently made:

Japan May Make JGB Bids Mandatory for Megabanks, Brokers

Japanese finance ministry plans to make mandatory from April that 20 brokerages and 3 megabanks bid for 3% of JGBs in enhanced liquidity auctions, Nikkei newspaper reports, without saying where it got the information.

Bidding is voluntary at present in the auctions which enables the ministry to offer additional popular issues of outstanding JGBs: Nikkei

Ministry will discuss plan with market participants next week: Nikkei

Plan aims at revitalizing JGB market liquidity and avoiding risk of interest rate spikes with BOJ buying 40-50% of all newly issued long-term bonds: Nikkei

For context…

And then there’s this!!