No one seems able to account for the rise in LIBOR-OIS. I think it’s a vain effort, and focuses on the wrong segments, but nonetheless there is considerable uncertainty which always casts suspicions into the shadows. That is important.Â

A few weeks ago, all the big bank analysts were alight with their theories. They couldn’t agree, as noted in this ZeroHedge article(thanks again T. Tateo). Despite the contributions of several market experts, actual experts for once, the only solid conclusion one might draw is that none of them really know.

Only one, Bank of America strategist Mark Cabana, seemed able to state the obvious:

We acknowledge these factors leave much to be desired and suggest that an unaccounted-for factor has been contributing to the recent market movements. However, the data available to us suggest BEAT is not the main culprit and that the aforementioned contributors and higher bill supply are likely the main drivers. [emphasis in article]

As I mentioned before, the FOMC’s patently ridiculous blaming of the bill issuance gets tossed around because they are the Fed. Even after all that has happened, none of which was supposed to happen if our central bankers were at all competent, their opinions on such matters are treated authoritatively anyway. It becomes lazy shorthand simply due to the fact no one will challenge what is nothing more than hollow pedigree.

Before continuing, let me be clear that I don’t know for sure, either. I am merely speculating along with everyone else, though I think based on a reasonably sound reading of the situation. What I present (have presented) seems to account for more of the facts than these others which account for only a limited set.

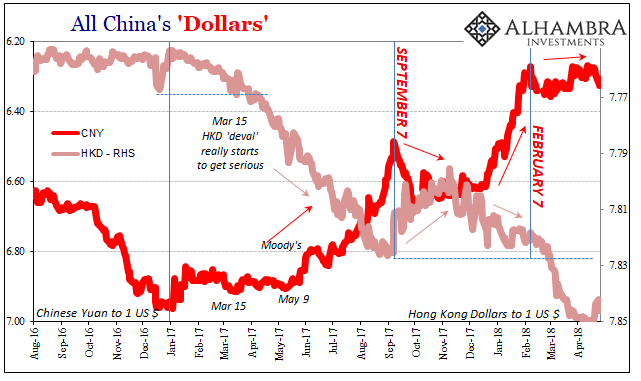

The big one is Hong Kong, but really beginning in Japan. I’m not the only who has noticed:

“The pressures that have built since the start of this year on the Hong Kong dollar are reminiscent of what happened 11 years ago,†wrote Simon Derrick, chief currency strategist at US bank BNY Mellon last week, when there was also a widening of the spread between the Hong Kong and the London interbank offered rates.

What has been seen recently in Hong Kong is “a further echo of market behaviour a year before the global financial crisisâ€, Derrick said.