Guest Post by Ramsey Su

Facing the Music

The last of the sub-prime loans were originated in early 2007. Â Of course, had regulators not been sleeping, these loans would never have been made in the first place. Â Had the various government agencies not subsequently intervened, the slate would have been wiped clean long go, even though it might have been painful. Â We know that was not the case. Â In fact, the opposite happened. Â There have been never-ending efforts to prevent foreclosures, as if that were a good thing. All it did was to postpone the inevitable. Â Is it finally time to face the music?

Leftover Junk

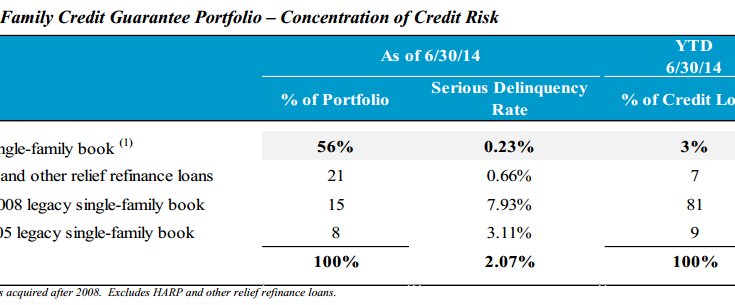

How much junk is left in the system?  Here is a table taken from Freddie Mac’s second quarter earnings release.

Freddie Mac’s single-family credit guarantee portfolio – click to enlarge.

It is not a pretty picture. Â 21% are HARP loans, which are by definition high LTV loans with some as high as over 125%. Â The qualifications of the borrowers are questionable but certainly not to the underwriting standards of a new loan. Â 15% are peak sub-prime vintage loans, originated between 2005-2008 while 8% are pre-2005 loans.

These are borrowers who either live under rocks, or most likely, borrowers who cannot qualify to refinance into more favorable terms.  In total, 44% of Freddie’s guaranteed portfolio are at risk if housing conditions deteriorate.

Fannie Mae probably has a similar mix while FHA’s guaranteed portfolio is likely to be much worse.

DelinquenciesÂ

In the mortgage business, the word delinquency has many different meanings, not to mention some qualitative definitions.  There are 30 days, 90 days or, as in the Freddie Mac table above, “serious delinquencyâ€.  Furthermore, there are modifications and other form of work-outs that result in these loans being labeled re-performing, even though delinquent amounts may have been rolled into a new loan.