The S&P 500 briefly traded above 2000 yesterday for the first time. The all-time high inspired some analysts to announce (not necessarily for the first time) that the stock market was in bubble territory. But there’s a reason for the bull market: economic growth. We can debate if the growth is sustainable or even genuine–some say it’s an artifact of central bank liquidity. But that’s a separate issue. Growth is still growth, and the market’s reacting to current conditions accordingly.

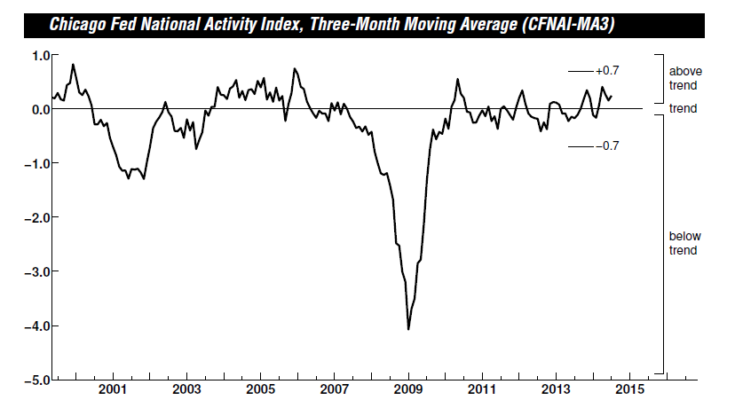

Consider yesterday’s monthly update of the Chicago Fed National Activity Index: the three-month average of this broad measure of US economic activity increased to 0.25 for the July reading. That’s in the upper range of values in recent years and a sign that growth is rolling along at a moderately above-trend pace. Only values below -0.70 indicate an “increasing likelihood†that a recession has started, according to guidelines from the Chicago Fed. By that standard, recession risk is quite low, based on the latest available set of indicators.

The news that the economy is humming along is hardly news at this point. My econometric modeling has been advising no less for some time now. In addition, it appears that the housing market’s stumble in the winter and spring is giving way to stronger growth, as recent updates suggest. Housing starts in July, for instance, rebounded sharply and existing home sales followed suit last month. Yesterday’s report on new home sales was a bit soft in terms of the monthly comparison, although the year-over-year trend looks more encouraging. Sales of newly built single-family homes increased 12.3% for the year through July—the highest annual rate so far this year.

As for equities, it’s no surprise to see stocks trending higher. As usual, the market has been discounting the future and it likes what it sees. That doesn’t mean that stocks are immune to corrections. Irrational exuberance can and does spoil the party at times. But with a generally positive macro backdrop, short-term market volatility alone isn’t going to change the big picture on the economy.