Econintersect:Â Traditional media and the blogosphere have presented a bewildering array of reports and opinion about what China is doing with respect to “managing” or “manipulating” its currency. The People’s Bank of China (PBoC), the country’s central bank, has repeatedly tightened credit and withdrawn liquidity for much of 2013 and the first two months of 2014. There have been reports that China is having a credit crisis, but all the stress points have been temporary and credit markets have not shut down.

Excerpt clip from graph presented at end of article.

Just last week China removed a total of 160 billion yuan ($27 billion) on two different days by issuing 14-day repos (repurchase agreements. In these operations the PBoC “sold” that amount of paper for 14 days which drained the currency from the economy. As opposed to earlier situations, most notably last June, short-term interest rates changed little during the week. The SHIBOR (Shanghai Interbank Offered Rate) has been quote volatile over the past six months, but the shorter terms (up to 1-month) have been in a down trend since the beginning of the year. The longer terms (3-month and up) have been mostly flat so far in 2014 (except for the 3-month, which dipped in that second half of February).

Click on graphic display for larger images.

Not shown in the graphs above are the rates from June 2013 when some of the interest rates spiked briefly well above 10%. See the graph below. That extreme has not happened since, although the volatility has still been notable.

According to caijing (28 February 2014):

Some analysts believe the central bank’s recent money-draining moves which were mainly taken to cope with hot-money inflows shouldn’t be interpreted as a signal of a tight monetary policy .

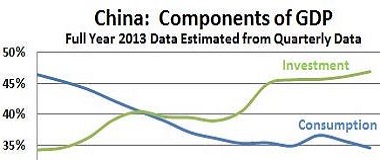

This may be part of the equation but some think there is a different motivation. David Keohane (in a FTAlphaville series “Up Shibor Creek”) thinks China will need to raise rates by 200 basis points, but that it will happen over a period of years. Such action would keep upward pressure on the value of the yuan (as long as the other three major currencies keep rates very low) but it is necessary to achieve a rebalancing away from massive investment toward increased consumer participation in the economy.