GreenSky Inc. (GSKY), a technology platform facilitating consumer loans at the point of purchase, IPO’s on Thursday, May 24. At a price range of $21 to $23 per share, the company plans to raise up to $902 million and has an expected market cap of ~$4.1 billion. At the midpoint of its price range, GSKY currently earns our Neutral rating.

GreenSky was recently valued as one of the largest fintech firms in the United States and its IPO is getting a lot attention. Its technology platform allows consumers to access small-balance loans (often with special interest terms) while managing the full loan transaction lifecycle, from application, to funding, to settlement.

While the firm is profitable, unlike some other recent IPOs, it is not without risks. This report aims to help investors sort through GreenSky’s financial filings to understand the fundamentals and valuation of this IPO.

NOPAT Reveals True Profits Are Rising

GSKY monetizes its platform by charging an upfront transaction fee every time a merchant receives a payment using the platform. It also charges the lending banks a recurring servicing fee over the life of a loan. The company notes active merchants grew 52% year-over-year (YoY) while transaction volume (or the dollar value of loans facilitated through GSKY) grew 21% YoY in 2017.

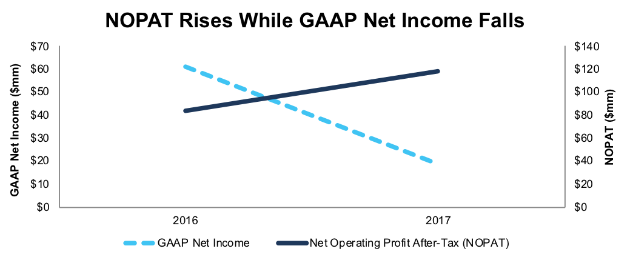

Unlike recent IPOs, GKSY is actually profitable. However, at first glance, GSKY’s 2017 pro-forma net income fell significantly from its net income attributable to class A unit holders in 2016. GAAP net income declined from $61 million in 2016 to $19 million in 2017, or 69%. However, Figure 1 shows that the after-tax operating profit (NOPAT) actually increased from $84 million to $118 million in 2017, or 41% year-over-year.

Figure 1: GKSY GAAP Net Income and NOPAT Since 2016

Sources: New Constructs, LLC and company filings

Non-operating items understated GKSY’s profitability in 2016 and more heavily in 2017, which caused the large decline in accounting results. In 2016, GSKY’s reported profits included a $25 million charge to participating interests, which was included as an operating expense on GSKY’s income statement. We remove this non-operating expense when calculating NOPAT to get at the true recurring profits of the business.

In 2017, Robo-Analyst uncovered larger non-operating expenses, such as:

- $108 million in minority interest expense

- $2.6 million in nonrecurring transaction expenses

- $2.1 million in fair value change in servicing liabilities