U.S. corporate earnings growth has slowed. Heck, if you are looking at companies in the Dow Industrials, earnings have actually declined for three of the last four quarters. Yet record highs for broader U.S. stock benchmarks continue stealing the headlines.

Are U.S. corporations genuinely thriving? In the aggregate, one can say that they’ve increased profitability through refinancing high interest rate debt into low interest rate debt, as well as kept down the cost of human resources compensation packages. Yet they are not selling products and services at a pace commensurate with longer-term success.

Well, aren’t the fundamental underpinnings of the economy strong? I suppose that depends upon whom you ask.

The percentage of working-aged individuals sits at 35-year lows. Yet others might point to the trend of headline unemployment improving over the course of the current five-year recovery. Economic growth in the first quarter came in at a shockingly low 0.1%. However, some explain away the weakness as a bump in the road due to harsher-than-usual weather patterns. Both home sales and home prices on the national stage have been declining since the previous summertime. Nevertheless, a number of analysts maintain that as mortgage rates have stabilized, and employment continues to pick up, demand for residential real estate will resume.

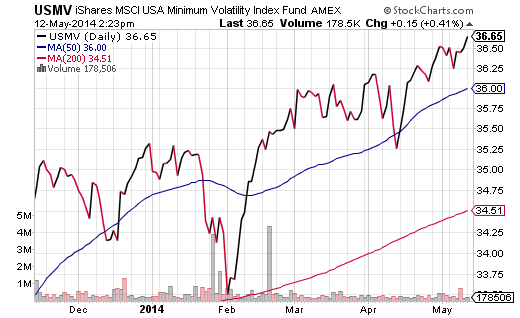

In some ways, none of the mixed messages matter. If large-cap U.S. equities can rocket to new records – in spite of questionable price-to-earnings ratios and in spite of economic uncertainty – you should continue to participate. Keep in mind, though, there are scores of domestic sub-sectors that have broken down below respective long-term trendlines (e.g., home builders, banks, Internet “tech,†etc.). I am sticking with less volatile U.S. assets like iShares USA Minimum Volatility (USMV).

What should you do if you have lightened up on riskier areas of the U.S. market and you now have a larger-than-desired money market position? From my vantage point, the international stock and bond arenas have more going for them than they have had in quite some time.