The main international story since the U.S. election is the rise in global bond yields. Trump’s election has led investors to believe a large increase in U.S. bond issuance is around the corner, leading to a sell-off of U.S. treasuries. Most other international news this week was positive. E.U. news points to continued expansion, Japan news surprised to the upside and UK news continued to show a strong, post-Brexit economy.Â

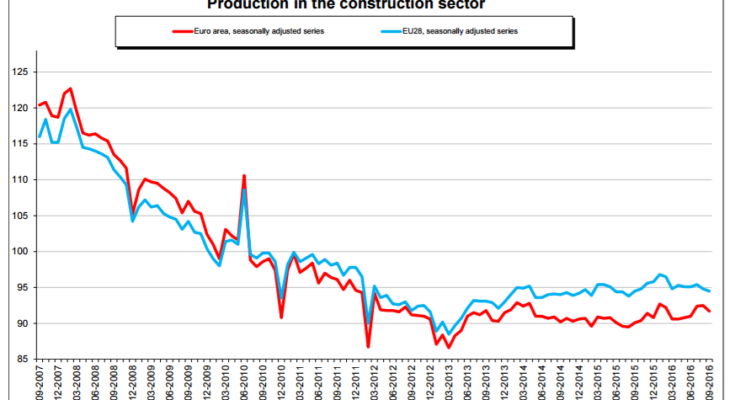

EU was positive. GDP increased .3% Q/Q and 1.6% Y/Y. The Y/Y rate has decreased over the last 4 quarters, falling from 2% in 4Q15 to its current 1.6% rate. Although industrial production increased 1.2% Y/Y, it’s been moving sideways since 12/15. And like industrial production, exports, which rose 2%, have also been moving sideways, but this time since 12/14, a full year longer than the IP number. Prices rose .5% M/M; this marks the 4th consecutive month when prices rose .1%. Finally, construction spending dropped .8%. But more importantly, the post-recession pattern of no meaningful gain continues:

In other EU news, the EU bond markets sold-off on the news of Trump’s win:

The so-called “Trumpflation†trade has seen a sharp sell-off in government bonds in the last week, as president-elect Donald Trump’s promises of higher infrastructure spending have raised expectations of higher inflation and faster interest rate rises.

However, domestic political issues have made Italy and Portugal the EU’s biggest sufferers this morning.Yields on Italy’s 10-year debt are up 7 basis points to 2.030 per cent, while yields on Portugal’s 10-year debt are up 11 basis points to 3.580 per cent. In Italy, an upcoming referendum on constitutional reform has created additional political uncertainty with the country’s banking system already in a fragile state, while Portugal’s Socialist government is pushing to implement a controversial anti-austerity budget.

The bond market sell-off isn’t limited to the EU; the US and Japan fixed income markets also dropped. In addition, Yves Mersch, a member of the ECB, gave a speech in which he argued that the ECB’s bond buying program should end as soon as possible (Google translator translation):

In order for the recovery to be sustained, we must tackle above all the causes of this global low-interest environment. But monetary policy can not stand alone. Furthermore, our measures are not designed to be a permanent part of the system. They have been used as temporary measures and must therefore be withdrawn as soon as possible.