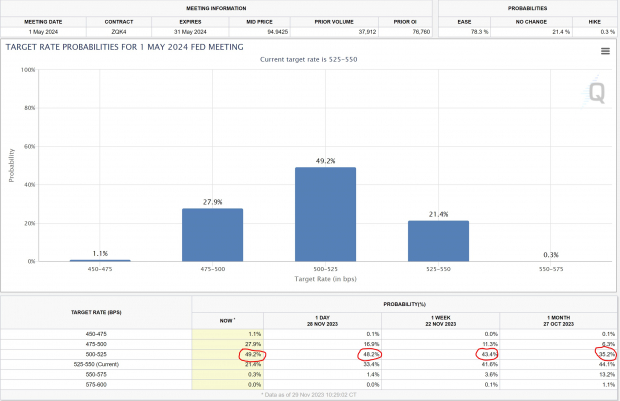

Image Source: CME GroupImplications of Rate CutsOf course, the rate of interest targeted by the US central bank is one of, if not the most important factors influencing markets. However, the primary levers being pulled are relatively straightforward.Lower interest rates mean cheaper credit and more free-flowing liquidity. It also means that investors will be pushed farther out on the risk curve, seeking higher returns from more speculative investments. This leads them into growth-oriented stocks and also causes multiple expansions, likely pushing this group of stocks higher.All of this is very bullish, and I think that the mid-cap technology sector may be one of the major beneficiaries of this evolving market environment.UpworkUpwork () is an online platform that connects businesses and individuals with freelance professionals and remote workers. Founded in 2015, Upwork offers a wide range of freelancers across various fields, including web development, design, writing, and marketing, making it a valuable resource for businesses seeking specialized talent on a project-by-project basis. The platform allows clients to find, hire, and collaborate with freelancers, making it a popular choice for companies looking to access flexible and skilled workforce solutions.Upwork has seen some significant upgrades to its FY23 earnings estimates, giving it a Zacks Rank #1 (Strong Buy) rating. FY23 earnings estimates have increased by 30% in the last month, and are forecast to climb from -$0.06 to $0.48 YoY.

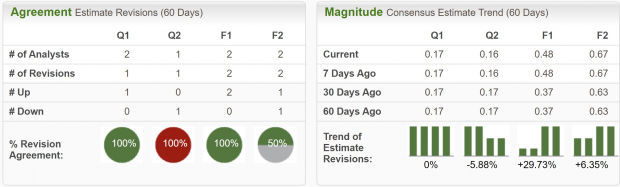

Image Source: CME GroupImplications of Rate CutsOf course, the rate of interest targeted by the US central bank is one of, if not the most important factors influencing markets. However, the primary levers being pulled are relatively straightforward.Lower interest rates mean cheaper credit and more free-flowing liquidity. It also means that investors will be pushed farther out on the risk curve, seeking higher returns from more speculative investments. This leads them into growth-oriented stocks and also causes multiple expansions, likely pushing this group of stocks higher.All of this is very bullish, and I think that the mid-cap technology sector may be one of the major beneficiaries of this evolving market environment.UpworkUpwork () is an online platform that connects businesses and individuals with freelance professionals and remote workers. Founded in 2015, Upwork offers a wide range of freelancers across various fields, including web development, design, writing, and marketing, making it a valuable resource for businesses seeking specialized talent on a project-by-project basis. The platform allows clients to find, hire, and collaborate with freelancers, making it a popular choice for companies looking to access flexible and skilled workforce solutions.Upwork has seen some significant upgrades to its FY23 earnings estimates, giving it a Zacks Rank #1 (Strong Buy) rating. FY23 earnings estimates have increased by 30% in the last month, and are forecast to climb from -$0.06 to $0.48 YoY. Image Source: Zacks Investment ResearchUpwork stock has also formed a convincing bottoming pattern this year and looks to be building a technical momentum setup. If UPWK’s price can break out above the $14.75 level, it should rally to new 18-month highs.Additionally, Upwork is trading at a forward earnings multiple of 30x, which when compared to its EPS growth forecasts is relatively cheap.

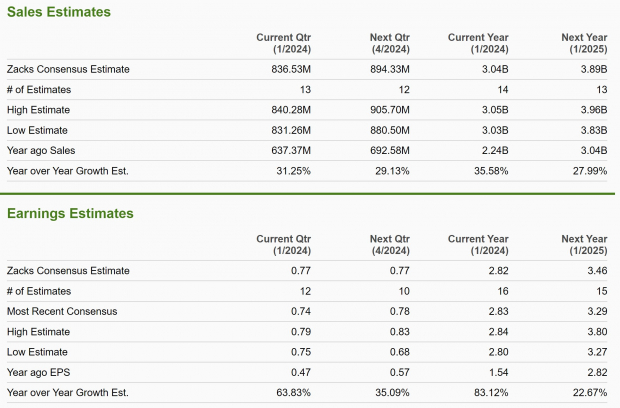

Image Source: Zacks Investment ResearchUpwork stock has also formed a convincing bottoming pattern this year and looks to be building a technical momentum setup. If UPWK’s price can break out above the $14.75 level, it should rally to new 18-month highs.Additionally, Upwork is trading at a forward earnings multiple of 30x, which when compared to its EPS growth forecasts is relatively cheap. Image Source: TradingViewCrowdStrikeCrowdStrike () is a cybersecurity company known for its cloud-native endpoint protection platform. Founded in 2011, CrowdStrike provides advanced cybersecurity solutions that help organizations detect, prevent, and respond to cyber threats and attacks in real-time.Its platform uses artificial intelligence and machine learning to protect endpoints and endpoints such as computers, servers, and mobile devices from various forms of cyber threats, making it a prominent player in the cybersecurity industry.Sales and earnings at CrowdStrike are expected to grow at a blistering pace, with annual sales growth forecasts at 35% and EPS at 83%. CrowdStrike also enjoys a Zacks Rank #2 (Buy) rating, reflecting upward trending earnings revisions.

Image Source: TradingViewCrowdStrikeCrowdStrike () is a cybersecurity company known for its cloud-native endpoint protection platform. Founded in 2011, CrowdStrike provides advanced cybersecurity solutions that help organizations detect, prevent, and respond to cyber threats and attacks in real-time.Its platform uses artificial intelligence and machine learning to protect endpoints and endpoints such as computers, servers, and mobile devices from various forms of cyber threats, making it a prominent player in the cybersecurity industry.Sales and earnings at CrowdStrike are expected to grow at a blistering pace, with annual sales growth forecasts at 35% and EPS at 83%. CrowdStrike also enjoys a Zacks Rank #2 (Buy) rating, reflecting upward trending earnings revisions. Image Source: Zacks Investment ResearchCrowdStrike stock has been leading the sector higher all year, and just today blasted 10% higher after breaking out from a bull flag last week.

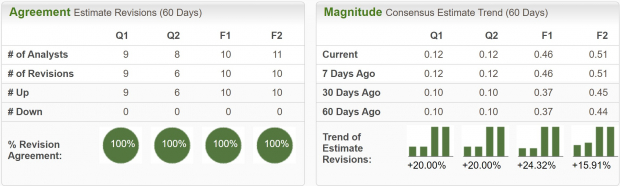

Image Source: Zacks Investment ResearchCrowdStrike stock has been leading the sector higher all year, and just today blasted 10% higher after breaking out from a bull flag last week. Image Source: TradingViewCloudflareCloudflare () is a global technology company that provides a wide range of cloud-based services to enhance the security, performance, and reliability of websites and online applications. Founded in 2009, Cloudflare offers services such as content delivery, DDoS protection, web application firewall, and domain name system (DNS) management.These services help businesses improve the speed and security of their online presence while mitigating threats and ensuring uptime. Cloudflare is widely recognized for its role in optimizing and safeguarding websites and applications across the internet.Cloudflare too has impressive growth estimates, with annual sales expected to climb 32% this year and EPS to grow over 250% YoY. Analysts have not missed this powerful trend and have unanimously raised earning estimates for the cyber security firm.

Image Source: TradingViewCloudflareCloudflare () is a global technology company that provides a wide range of cloud-based services to enhance the security, performance, and reliability of websites and online applications. Founded in 2009, Cloudflare offers services such as content delivery, DDoS protection, web application firewall, and domain name system (DNS) management.These services help businesses improve the speed and security of their online presence while mitigating threats and ensuring uptime. Cloudflare is widely recognized for its role in optimizing and safeguarding websites and applications across the internet.Cloudflare too has impressive growth estimates, with annual sales expected to climb 32% this year and EPS to grow over 250% YoY. Analysts have not missed this powerful trend and have unanimously raised earning estimates for the cyber security firm. Image Source: Zacks Investment ResearchMomentum has been strongly favoring NET stock as it too pushed to new YTD highs today. After breaking out from a broader year-long consolidation, the stock is forming and breaking out from minor bull flags as seen this week.

Image Source: Zacks Investment ResearchMomentum has been strongly favoring NET stock as it too pushed to new YTD highs today. After breaking out from a broader year-long consolidation, the stock is forming and breaking out from minor bull flags as seen this week. Image Source: TradingViewBottom LineAs the market continues to accept the now shifting interest rate regime, it is likely that we will see further bull runs, especially in the high-growth, mid-cap technology sector.More By This Author:3 Funds To Boost Your Portfolio On Soaring Holiday Season Sales 3 Stocks To Gain As Consumer Confidence Rebounds Bear Of The Day: Guess

Image Source: TradingViewBottom LineAs the market continues to accept the now shifting interest rate regime, it is likely that we will see further bull runs, especially in the high-growth, mid-cap technology sector.More By This Author:3 Funds To Boost Your Portfolio On Soaring Holiday Season Sales 3 Stocks To Gain As Consumer Confidence Rebounds Bear Of The Day: Guess

Interest Rate Cuts On The Horizon: 3 Stocks Primed To Benefit