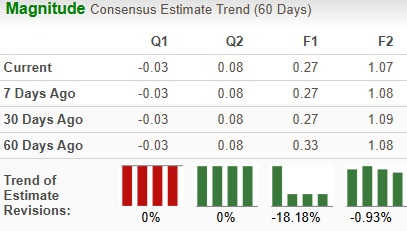

Intel Corporation ( – ) is scheduled to report third-quarter 2024 earnings on . The Zacks Consensus Estimate for revenues and loss is pegged at $13.01 billion and 3 cents per share, respectively. Earnings estimates for INTC have declined from 33 cents per share to 27 cents for 2024 and from $1.08 per share to $1.07 for 2025 over the past 60 days.

INTC Estimate Trend Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

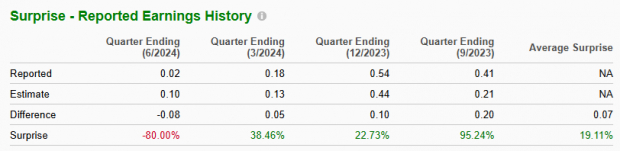

Earnings Surprise HistoryThe leading semiconductor manufacturer delivered a four-quarter earnings surprise of 19.1%, on average, beating estimates thrice. In the last reported quarter, the company’s earnings surprise was negative 80%. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Earnings WhispersOur proven model does not predict an earnings beat for Intel for the third quarter. The combination of a positive and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is not the case here. You can uncover the best stocks to buy or sell before they’re reported with our . Intel currently has an ESP of 0.00% with a Zacks Rank #4 (Sell). More By This Author:American Airlines Surpasses Q3 Earnings And Revenue Estimates IBM Tops Q3 Earnings EstimatesCoca-Cola Surpasses Q3 Earnings And Revenue Estimates

INTC Stock Before Q3 Earnings Release: To Buy Or Not To Buy?