On Friday, I noticed a chart I hadn’t seen before and by virtue of not having seen it, I wasn’t entirely sure what to make of it.

So what I decided to do was, I decided to wait to comment until someone else confirmed that they hadn’t seen it before either. See how that works? It gives me some plausible deniability – if at least one other person on the planet wasn’t watching it, well then even if everyone else was, at least I’m not the only person who wasn’t paying attention.

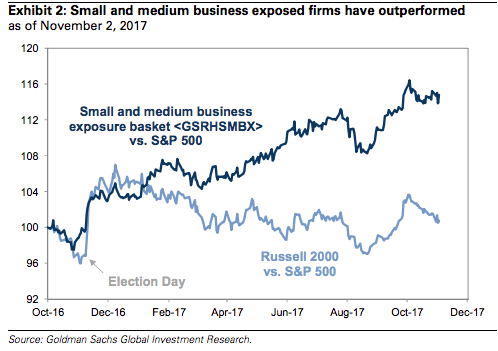

This morning, I got what I was looking for, because as it turns out, Bloomberg’s Michael Regan is in the same boat as me in terms of thinking that the following chart from Goldman is “quirkyâ€:

“Perhaps the most notable of the many so-called ‘Trump trades’ has been the rise of companies with the highest small and medium business exposure,†Goldman wrote on Friday, before explaining that “the median stock in this basket generates 71% of its sales from small-and-mid-sized business customers.â€

My knee-jerk reaction to that was that it seems like a tortured attempt to find a “Trump trade†that hasn’t been faded and honestly, Goldman didn’t do themselves any favors by plotting it against the poster child for faded Trump trades (i.e. the Russell vs. the S&P).

The reason I say “tortured†is because if you just kind of run down the list, you won’t see much in the way of evidence that anyone still believes in Trumpian reflation.

Seeing it in the curve? No…

Are high tax companies outperforming? No…

Value versus growth? God no…

So it kind of seems like we’re now searching far and wide for anything that supports the notion that investors are still confident in the “Trump trade.†But who am I to question Goldman? Just because I’ve never heard of ticker “GSRHSMBX†doesn’t mean it’s not important.