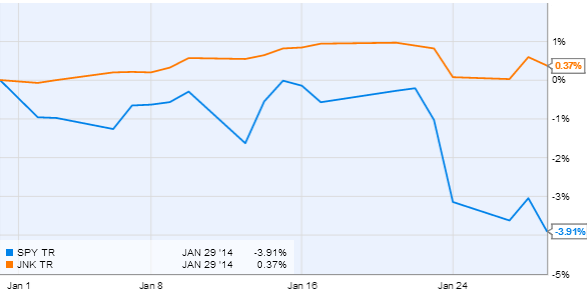

The US corporate high yield market remains incredibly resilient in the face of increasing global volatility. Year to date the broad HY index has outperformed the S&P500 by over 4.25%.

Â

|

| SPY =Â SPDR S&P 500 ETF; JNK =Â SPDR Barclays High Yield Bond ETF (source: Ycharts) |

One reason for this stability is the strong performance of the treasury market this month. Also many investors have become quite comfortable (perhaps too comfortable) with junk debt. Part of the reason is the low default rates recently as well as vibrant primary markets that have been willing to refinance (roll) maturing debt. In addition, supply of new bonds has been relatively light, while fund inflows remain robust (see story). As a result HY spreads are less than 10bp higher than they were at the end of last year.

Â

Experienced analysis and investors in this space openly admit that it’s just a “matter of time” before this market “cracks”. It simply needs a catalyst, such as a large unexpected corporate default. Maybe a major event in the sovereign bond market could dislodge HY. Short of that, junk bonds could remain at frothy valuations for some time.Â