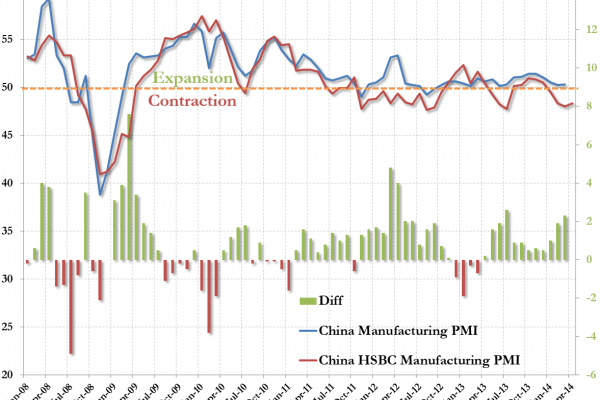

HSBC’s (Flash) China Manufacturing PMI for April met expectations at 48.3 – holding at its 2nd lowest in 20 months. This is the 4 month of contraction and 4th month without a beat of expectations. April’s flash (preliminary) print rose modestly over March’s 48.0 but all sub-indices remain weak though some 2nd derivatives are shifting. Employment is worsening at a faster pace and new export orders contracted. While the world waits open-mouthed for the next Chinese stimulus (which they have now explained will be limited and targeted and not 2009-style) and bloviators expound on last night’s RRR cut for rural banks (remember, they do not have a liquidity issue, banks are hording PBOC cash and not lending – due to credit risk concerns), it seems no matter what the PMI (weak, weaker, or weakest) the reforms are being stuck to, CNY is being allowed to weaken, and no new avalanche of credit creation (commodity-backed or not) is coming anytime soon.

Â

Most market participants believe HSBC’s survey is more weighted towards small and medium-sized businesses than the official government data (which is likely more biased to SOEs and larger enterprises) and Markit’s stratification description suggests a more accurate representation of the overall economy – therefore HSBC better reflects the tightening liquidity conditions than China’s official data.

Overall the sub-indices are weak with some hope for the ever optimistic that the pace of collapse is slowing

CNY has dropped to fresh 14-month lows against the USD… At 6.2423, USDCNY is back to pre-QE4EVA levels in Dec 2012 – 6.40 next target

Charts: Bloomberg and Markit Economics