For the 4th month in a row, China’s composite PMI fell (with new orders tumbling) – this time to the lowest levels since Nov 2011 and firmly in contractionary territory. However, in the exact antithesis of the manufacturing PMI data, tonight’s non-manufacturing data saw the official government data miss expectations and drop (manufacturing rose) while HSBC’s services PMI rose (HSBC’s manufacturing dropped). This was enough (along with an Aussie retail data miss) to send AUDJPY into conniptions jerking lower then higher then lower as the algos just could not comprehend the levels of absurdity that was flooding their valves. Japanese PMI strolled along in its neither here nor there zone and Aussie PMI tumbled back into contraction after one month of exuberance. In the famous words of Frank Valli, oh what a night.

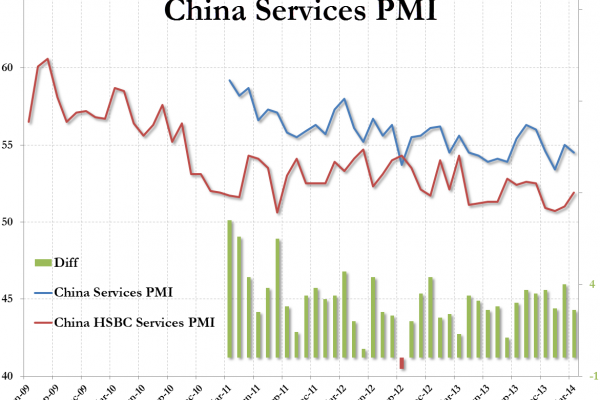

Chinese Services PMI rose (and fell)…

Â

But it was not enough to save the Composite PMI from its lowest level since Nov 2011…

Â

Aussie Retail Sales missed by the most in 9 months…

Â

And that schizophrenia sent AUDJPY mad…

And for all those who were hoping for the massive stimulus to save the world from China… they just fired the world’s smallest and most focused bazooka – we suspect the money-hungry will be disappointed (for sure Chinese stocks are at the moment)…

As The BBC reports,

China’s government has acted for the first time this year to boost economic growth after a string of disappointing data led to fears of a slowdown.

The government said it will cut taxes on small firms and speed up the construction of railway lines.

The measures had previously been included in China’s economic work plan for 2014.

However, they had not before put them together in a package aimed at boosting growth.

“We will find innovative ways including fiscal and financial methods to…steady economic growth,” the cabinet said in a statement on the government’s website.

After its weekly meeting on Wednesday, the government announced the measures, including an 18% increase in the total number of railway lines being built compared to last year. Most of those tracks will be laid in central and western regions of the country.

To finance the railway investment, the government will sell 150 billion yuan ($24.6bn; £14.5bn) worth of government bonds.

As further stimulus, Chinese authorities said they will also extend tax provisions granted to small businesses into 2016.

“We must roll out policies that spur businesses’ vitality, effectively increase demand and boost jobs,” the government said.

…

Chinese Premier Li Keqiang has sought to reassure markets that the government remains prepared to act, and has previously emphasized that creating jobs – as opposed to a specific growth target – was the most important item on his agenda.