Earlier this week in “The Trump Premium Has Drained Out,†we noted that at least one bank thinks there’s some asymmetric upside in the financials from here.

Basically, financials are another “Trump trade†that investors have faded this year as tax reform got pushed further and further into the future and as the generally dim prospects for the administration’s agenda caused investors to sour on the reflation narrative in the U.S.

The steady grind lower in yields (and flatter in the curve) and the dollar’s abysmal YTD performance mark a stark contrast with what we saw in the immediate aftermath of the election and the remarkable shift in positioning (from short USTs and long USD in January to long TY and short USD more recently) underscore the market’s growing angst and mounting impatience.

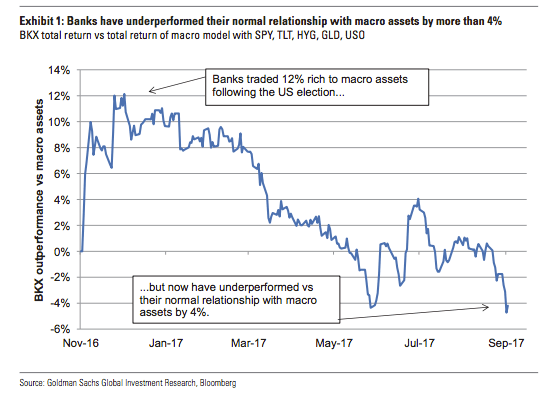

All of that said, when it comes to financials, investors still think regulatory reform and tax cuts are in the cards and the prospect of shareholder returns post CCAR helps sentiment as well. For their part (and this gets us back to what we said here at the outset about some asymmetric upside in the financials), Goldman notes that based on their model, banks have gone from outperforming their “normal†relationship with macro assets by a full 12% in the immediate aftermath of the election (the “Trump bumpâ€) to underperforming the same model by 4%:

The implication is that there’s considerable room to run to the upside in the event anything at all goes right in terms of the fiscal agenda (it’s the old “how much worse can this possibly get?†trade).

Well, Goldman is out on Friday evening reminding you that Fed balance sheet normalization could give investors another excuse to get excited about the banks. “Financials’ returns vs. the S&P 500 continue to exhibit nearly the strongest correlation with Treasury yields on record,†the bank notes. Here’s a visual: