One of the great fears, if not the greatest for stock market investors, is that a large portion of their capital will be wiped out in a stock market “crashâ€. This fear of losing it all is a primary reason why so many investors lose out in the stock market by “buying high and selling owâ€. It is difficult, if not impossible, to accurately predict large market drops. They almost always come as a surprise. The only way to manage your stock portfolio in regards to market drops is to understand what they are and what will happen when stock prices take a tumble.

Definitions to Know

Stock market participants and watchers have developed criteria for what are commonly referred to as a market correction and a bear market.

A stock market correction has happened when the major stock market indexes have declined by more than 10% from a previous high. Historically, the stock market has experienced a correction every 18 to 24 months.

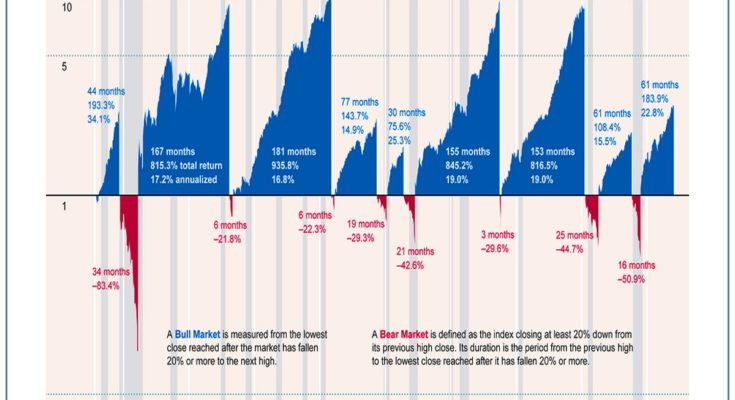

A Bear Market is defined as a stock market drop of greater than 20%. In function, most bear markets have produced declines of 30% to 50% below the peak starting point. Depending how you time the cut-offs, the U.S. stock market has experienced 7 to 10 bear markets since the Big One in 1929-1932. The length of a bear market is measured in months, with an average length of about 18 months.

Bull Markets are the period between the bottom of one bear market and the start of the next. Historically, bull markets have gone on for years, with 10-year plus upswings more common than not. The current bull market is in its 6th year.

You can also have corrections and bear markets in individual sectors of the market or economy. For example, the energy sector of the S&P 500 dropped by 30% from its June 2014 peak to the January 2015 bottom.

There is no firm definition for a market crash. To me, a crash in the current economy is a really fast moving bear market. Crude oil crashed in the fourth quarter of 2014. The only real, wealth wiping crash to date was the 1929-1932 wipe out associated with the Great Depression. The use of the word crash in the financial media and the marketing of financial products is mostly just a scare tactic.