The rating agencies in the U.S. have enjoyed an enormous bull market since the Great Recession ended almost a decade ago. Their stocks have all moved significantly higher as their business models have adapted to a world that is moving towards greater analytical capabilities for investors using real-time data, in addition to the core ratings business.

In this article, we’ll take a look at the three largest publicly-traded ratings agencies in the US – Morningstar (MORN), Moody’s (MCO) and S&P Global (SPGI) – and rank them according to their total return potential. Fitch Ratings is also a major ratings agency, but it is not publicly-traded.

Morningstar, Moody’s, and S&P Global are all on our list of 1,263 dividend-paying financial services stocks.

Rankings are derived from our Sure Analysis Research Database, which ranks stocks based upon the combination of their dividend yield, earnings-per-share growth potential and valuation to compute total returns. The stocks are listed in order below, with #1 being the most attractive for investors today.

Read on to see which ratings agency stock is ranked the highest in our Sure Analysis Research Database.

Ratings Agency Dividend Stock #3 – Morningstar, Inc.

Morningstar, Inc. was founded in 1984 by Joe Mansueto in his apartment in Chicago. The following year, Morningstar produced its first ratings for mutual funds and since then, it has grown into a financial services powerhouse that provides a variety of related services to individual and institutional investors alike. The company today is approaching $1 billion in annual revenue and has a market cap of $5.6 billion.

The company’s recently reported Q1 earnings which were very strong as it saw revenue rise 16.2% over the comparable quarter last year. Organic revenue was the driver as it contributed 13.7% of the total gain, due in part to the company’s relatively new PitchBook service, which was acquired just over a year ago. Earnings-per-share more than doubled as a much lower tax rate as well as some operating leverage contributed as a result of much higher revenue.

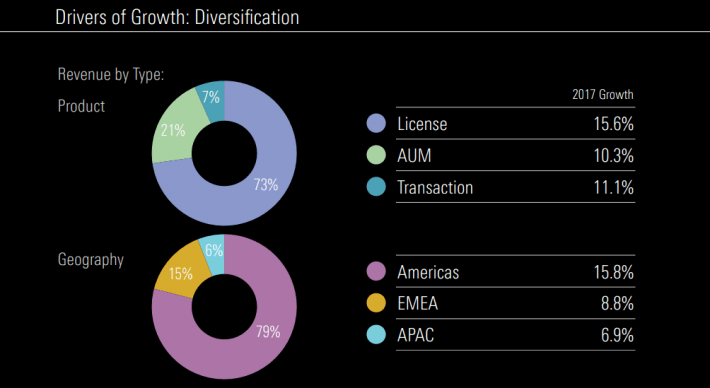

Source:Â Investor presentation, page 48

This slide from the company’s recent shareholder meeting shows the enormous amount of growth the company is achieving and the very important fact that it is broad-based. Its license business continues to be the primary driver of revenue growth and with the success of the PitchBook business – which continues to post double-digit gains in revenue – Morningstar’s growth looks set to continue.

Morningstar’s earnings-per-share history over the past decade paints a picture of a stable, yet growing company. It has seen average earnings-per-share growth of 6% in the past ten years, which is no small feat given the wide array of economic conditions that have existed in the US in that time frame, as well as the rapidly-changing landscape of the ratings business. To that end, we see Morningstar as producing 6.1% average earnings-per-share growth annually going forward.