The United States national debt is currently about $20 trillion, and the federal government is paying some of the lowest interest rates in history on that debt. The Federal Reserve has raised interest rates four times now, and is publicly considering another five increases, for a total increase of roughly 2.25%.

What will be the impact on the national debt and deficits if the interest payments on the debt jump upwards because of the actions of the Fed?

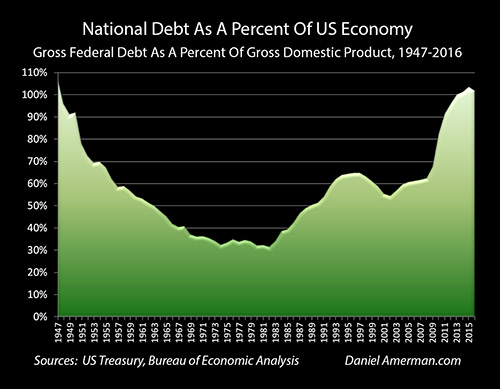

We have a history in recent decades of the Federal Reserve going through cycles of increasing and decreasing interest rates.However, these occurred when the national debt was much smaller than it is today, both in dollar terms and when compared to the size of the economy, as shown above.

This analysis examines the impact of the Fed’s recent and planned future rate increases on a national debt of $20 trillion. Over time, there is indeed a powerful impact on annual national deficits and the total debt, as well as the future ability of the United States government to make promised Social Security and Medicare benefits in full.

A nation that is $20 trillion in debt has fundamental constraints when it comes to interest rates that would not exist at lower debt levels. These constraints are likely to have a powerful influence on future yields and prices in all the major investment categories, including stocks, bonds and real estate.

Analysis

1) As shown above, effective Federal Funds rates were reduced to the lowest levels in modern financial history in the midst of the financial crisis of 2008. After remaining at record lows for seven years, with targeted rates of 0.0% to 0.25%, there have been four increases of 0.25% each between December of 2015 and June of 2017. This has brought the current target for overnight rates to between 1.0% and 1.25%.

The Fed is currently discussing raising rates by another 0.25% in 2017, and possibly making four more increases of likely 0.25% each in 2018. The amount and timing of such increases are never certain in advance, but if this or something like it happens, then there will be a total rate increase of 2.25% between the end of 2015 and the end of 2018.

In this analysis, we will use two scenarios to examine how the Federal Reserve interest rate increases could increase future federal government deficits and the level of the national debt. For the base scenario “A”, we will leave the average interest rate paid on the national debt at its current level of about 2.25%. For scenario “B”, we will increase rates by 2.25%, up to a total average rate of 4.50%.

2) Â In understanding how the Fed increasing interest rates impacts the budget, it is critical to keep in mind that the national debt has short term, medium term and long term components, with a weighted average life of about 5.8 years. So rate increases by the Fed initially fully impact only short term borrowing, and then slowly increase the average interest rate paid by the government as medium term and long term bonds gradually mature and are rolled over at the new and higher interest rates. This analysis uses a simplified term structure for the federal debt, with an average life of 5.5 years, and assumes that all rates move together.

3) To understand the impact of interest rate increases in isolation, Social Security, Medicare and Medicaid spending is kept level as a percent of the economy at current rates. In practice, these benefits are expected to rise sharply as the Boomers grow older, which will sharply increase deficits and debts from those shown.

Deficits Over The Next Ten Years

4) Scenario A, as shown above, is our base scenario, with no interest rate increases.

Scenario B shows the impact of rates going up by 2.25%. The initial increases in interest payments and the deficit are low – because most of the national debt is not initially affected. Interest payments are “only” $38 billion greater in the first year. The difference in the deficit is still less than $100 billion per year by the time we are two years out.

What this shows is that Federal Reserve has a great deal of latitude to move rates around in a moderate range over the next several years, without having any major initial impact on annual deficits or the size of the national debt. The interest paid on the national debt does not prevent the Fed from raising interest rates in 2017 and 2018 – so long as we restrict ourselves to the short term.

However, as time goes by, more and more of the “old” debt matures and is rolled over at the new and higher interest rates – and then the cost to federal government starts to grow rapidly.

5) By five years out, the Federal Reserve raising rates by 2.25% means that the United States government is paying $802 billion per year in interest expenses, rather than $521 billion. So the Fed will have increased the annual cost of the national debt by 46%, or $281 billion per year compared to what interest payments would have been.