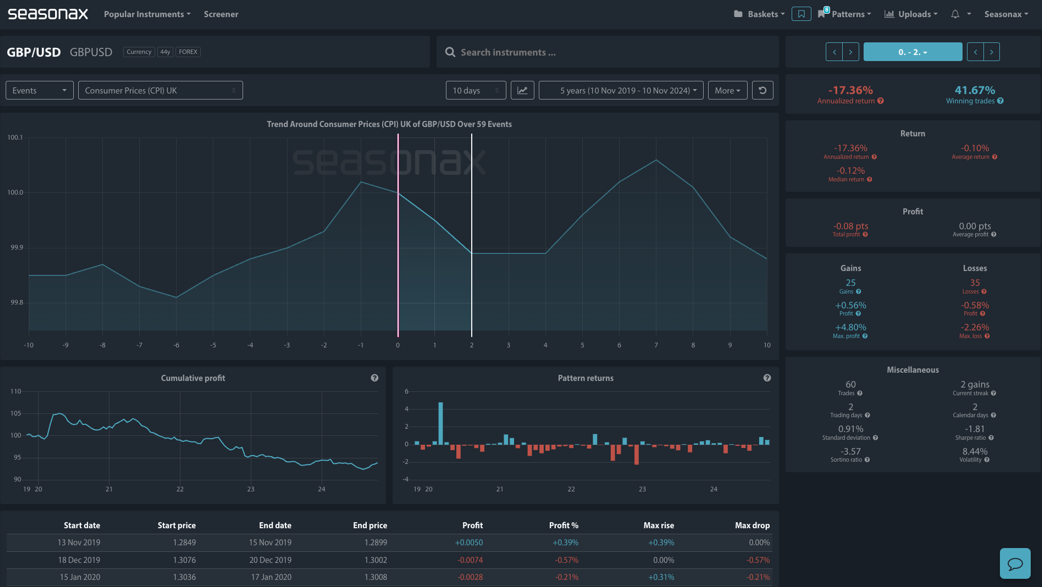

At its November 7 meeting, the Bank of England cut rates by 25 basis points to 4.75%, with Governor Andrew Bailey emphasizing a cautious approach due to persistent inflation risks, particularly in services. Though only a 20% chance of another rate cut in December is priced in by markets, dovish labor CPI data could shift expectations. Upcoming inflation reports are likely to heavily influence the Bank’s stance. The BoE forecasts inflation to persist into 2025 at 2.75%, balancing between controlling inflation and supporting economic growth. If CPI data on Wednesday comes in below market’s expectations markets may reprice rate cuts sooner, though a more definitive policy adjustment may be delayed if inflation proves resilient.This is where Seasonax’s event feature is extremely useful. The GBPUSD’s reaction to the UK CPI print over the last 5 years has seen a bias for falls. Furthermore, the extent of those falls have been as high as 2.26% as it was in December 2022. So, if the UK CPI print does surprise analysts with a below market’s expectation print watch out for GBPUSD selling and note that any falls are on average for -0.58%, so that can help set expectations for sellers.(Click on image to enlarge) Technically, there are major support and resistance levels marked below which will provide natural target and turn around levels for the GBPUSD. These are the noteworthy levels traders will be eyeing around the UK CPI event and can be useful to help with potential targets and stop placements.(Click on image to enlarge)

Technically, there are major support and resistance levels marked below which will provide natural target and turn around levels for the GBPUSD. These are the noteworthy levels traders will be eyeing around the UK CPI event and can be useful to help with potential targets and stop placements.(Click on image to enlarge) Trade risks

Trade risks

The main risk is from any unexpected moves higher in inflation which can further support the GBPUSD pair.Video Length: 00:02:04More By This Author:Novo Nordisk Aims For The Top: CagriSema Poised For Breakthrough Seasonal Opportunities In The Dax Will The Dollar Rise After The US Election?

How Much Lower Could Wednesday’s UK CPI Print Sink The GDP?