Housing markets are one itsy-bitsy recession away from a collapse in domestic and foreign demand by marginal buyers.

There are two attractive delusions that are ever-present in financial markets: One is this time it’s different, because of unique conditions that have never ever manifested before in the history of the world, and the second is there are no cycles, they are illusions created by cherry-picked data; furthermore, markets are now completely controlled by central banks so cycles have vanished.

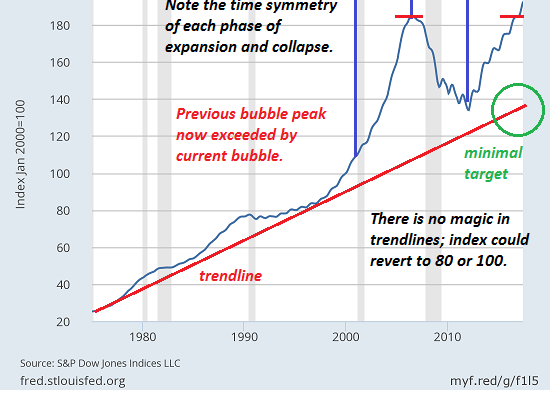

While it’s easy to see why these delusions are attractive, let’s take a look at a widely used measure of the U.S. housing market, the Case-Shiller Index:

If we look at this chart with fresh eyes, a few things pop out:

1. The U.S. housing market had a this time it’s different experience in the 2000s, as an unprecedented housing bubble inflated, pushing housing far above the trendline of the Case-Shiller National Home Price Index.

2. It turned out this time wasn’t different as this extreme of over-valuation collapsed.

3. For a variety of reasons (massive central bank and state intervention, the socialization of the mortgage market via federally guaranteed mortgages, historically low mortgage rates, massive purchases of mortgage backed securities by the Federal Reserve, etc.), the collapse in prices did not return to the trendline.

4. There is a remarkable time symmetry in each phase of expansion and collapse; each phase took roughly the same period of time to travel from trough to peak and peak to trough.

5. The Index has now exceeded the previous bubble peak, suggesting this time it’s different once again dominates the zeitgeist.

6. Those denying the existence of cycles have difficulty adequately explain away the classic cyclical nature of the 2000-2008 bubble rise and its collapse, and the subsequent expansion of housing prices in a near-perfect mirror-image of the first housing bubble’s steep ascent.