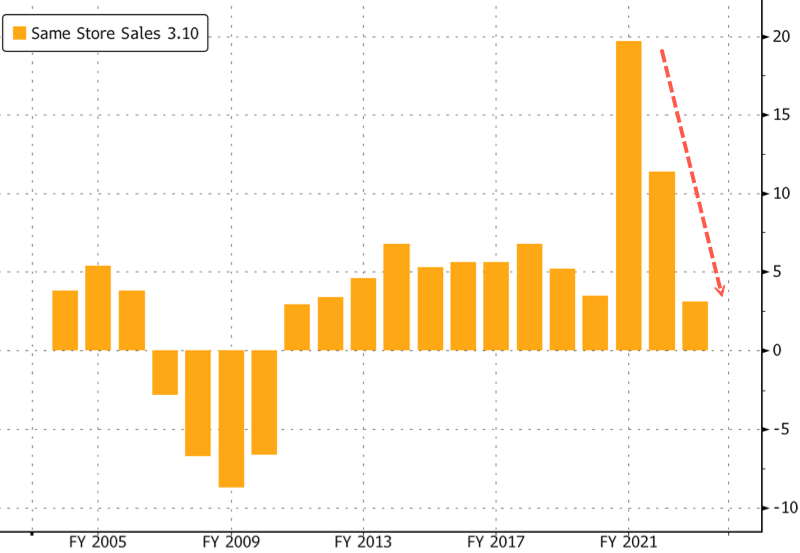

Home Depot’s sales fell for the fifth straight quarter as the country’s largest home improvement retailer felt the impacts of higher mortgage rates that have put a big freeze on the housing market. Fourth-quarter revenue came in at $34.79 billion, down from $35.83 in the prior-year period. The figure still beat $34.61 billion that analysts surveyed by Bloomberg expected. Comparable sales, a key indicator of a retailer’s health, fell 3.5%. The retailer predicted a 1% decline in comparable revenue for this year. Analysts have been expecting a rise of .2%.  Here’s a snapshot of fourth-quarter earnings (courtesy of Bloomberg):

Here’s a snapshot of fourth-quarter earnings (courtesy of Bloomberg):

And the fiscal 2024 forecast (courtesy of Bloomberg):

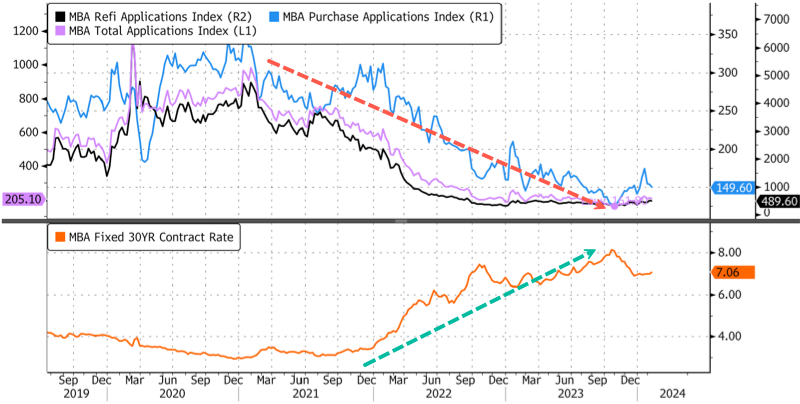

Shares of Home Depot are down 2% in premarket trading in New York.  CEO Ted Decker wrote in a statement: “After three years of exceptional growth for our business, 2023 was a year of moderation.” Elevated mortgage rates have pushed mortgage applications to a multi-decade low.

CEO Ted Decker wrote in a statement: “After three years of exceptional growth for our business, 2023 was a year of moderation.” Elevated mortgage rates have pushed mortgage applications to a multi-decade low.  Even with the ongoing slowdown in the housing market, Wall Street analysts maintain optimism about the retailer’s long-term prospects. Just weeks ago, analysts at Wedbush Securities upgraded Home Depot from “neutral” to “outperform,” pointing to a “rebounding industry environment with healthy Pro and general employment, solid wage growth and homeowner spending power from continued home-price appreciation.”More By This Author:China Supercharges Stimulus With Biggest Cut In Mortgage Reference Rate On RecordWith Charge Offs Soaring, Capital One To Buy Discover, Creating Credit Card GiantKey Events This Week: Nvidia Earnings And FOMC Minutes

Even with the ongoing slowdown in the housing market, Wall Street analysts maintain optimism about the retailer’s long-term prospects. Just weeks ago, analysts at Wedbush Securities upgraded Home Depot from “neutral” to “outperform,” pointing to a “rebounding industry environment with healthy Pro and general employment, solid wage growth and homeowner spending power from continued home-price appreciation.”More By This Author:China Supercharges Stimulus With Biggest Cut In Mortgage Reference Rate On RecordWith Charge Offs Soaring, Capital One To Buy Discover, Creating Credit Card GiantKey Events This Week: Nvidia Earnings And FOMC Minutes