The major U.S. payment processor stocks are on a roll. In the past 5 years, shares of Visa (V) and MasterCard (MA), have generated annual returns of 24.9% and 28.1%, respectively. Both stocks have trounced the broader market in that time, as the SPDR 500 ETF (SPY) has returned 12.9% in that time.

The third-largest payment processor by market capitalization, American Express (AXP), has generated annualized returns of 6.9% in the past five years, which is still a respectable rate of return given the company struggled through the loss of a major customer.

Visa, MasterCard, and American Express are in Sure Dividend’s database of financial-sector stocks. They also rank highly in the Sure Analysis Research Database. We expect annual returns of 10%+ for all three stocks going forward, mainly because they are benefiting from a major structural shift.

The U.S. is increasingly moving towards a cashless society. Consumers, particularly among younger generations, are much more comfortable performing financial transactions without using cash.

This article will discuss the economic and social trends that have caused a modern-day gold rush for the three largest U.S. payment processors.

Payment Processor #1: American Express

- Expected Returns: 11%-12% Per Year

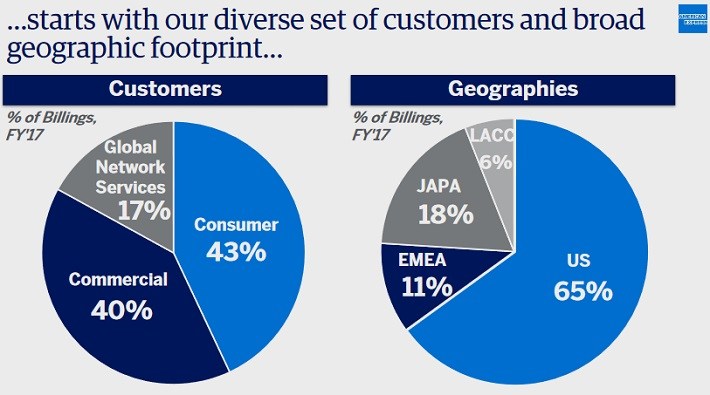

American Express was founded in 1850, and currently has a market capitalization of $85 billion. It has a diverse business model in terms of customer type and geographic markets.

Source:Â 2018 Investor Day, page 12

The company had struggled in recent years, due to the loss of its major customer, Costco (COST). Ameican Express had issued Costco co-branded cards, but sold the portfolio to Citigroup and Visa. As a result, American Express reported revenue declines in 2015 and 2016. Fortunately, the company has returned to growth. Revenue and earnings-per-share both increased 4% in 2017.

The company is off to an even better start to 2018. On April 18 American Express announced first-quarter earnings. The company reported revenue of $9.7 billion, up 12% year-over-year. Earnings-per-share of $1.86 were an increase of 38% from the same quarter a year ago. Both figures handily surpassed estimates. Revenue and earnings-per-share beat analyst expectations by $580 million and $0.15, respectively.

During the quarter, American Express recorded billed business growth of 10%, an acceleration from an already strong pace from 9% in the previous quarter. Billed business increases are a major driver of growth for American Express, as is interest income, which grew by 23% last quarter thanks to 16% loan growth.

For the full year, American Express expects earnings-per-share to reach the high end of its previous guidance, which is a range of $6.90 to $7.30 per share. At the midpoint of guidance, American Express expects 21% earnings growth for 2018. Revenue is expected to grow 8% for the year. Share repurchases are an additional catalyst for earnings growth. American Express generates lots of cash flow, which allows the company to buy back its own stock. The company reduced shares outstanding by 5% in 2017, and will resume its buyback program in the 2018 third quarter.

There should be plenty of runway for American Express to continue a high rate of growth moving forward. Penetration rates for card addressable spend is still fairly low around the globe, which leaves ample room for growth, particularly in the consumer segment.