Data/Event Risks

Data/Event Risks

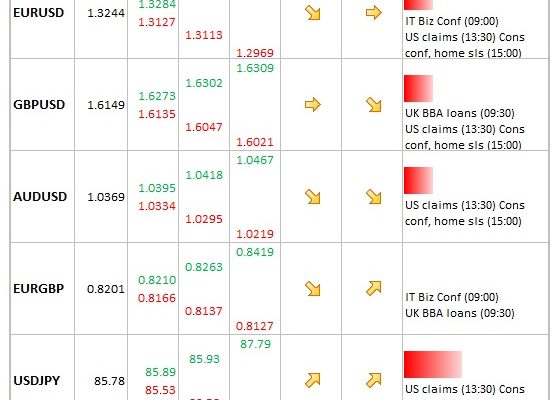

- EUR: The Italian data can sometimes impact, but it has to be way off expectations for this to happen.

- USD: New home sales data expected to be firmer at 3.3% MoM increase. Consumer confidence seen softer at 70.0. Both would have to be substantially out of line to affect steady dollar tone.

Idea of the Day

The US is now acting out how to deal with the passing of the fiscal cliff deadline on 1st Jan, when a number of tax increases and spending cuts are set to come into force. Of course, any agreement reached in the New Year could be back-dated to the beginning of the year, but the damage to the external image of the US is done, as well as the impact from delayed investment and spending decisions. But this is just the start, as there remains the debt ceiling expiry to be sorted once again (there are about two months left before it will impact) and even if a deal were stitched together in the coming days, a downgrade still remains a distinct possibility as the US displays an ongoing reluctance to tackle the longer-term budget issues. Near term, the delay is likely to be dollar-positive, but the bigger picture remains negative against this backdrop.

Latest FX News

- JPY: The yen weakening on further tough talk from the incoming administration. The new finance minister (Aso) said that the Bank of Japan had been insensitive to the problem of deflation. USD/JPY made high of 85.87 in Asia session, last seen after bout of BoJ intervention in late 2010.

- USD: Â Treasury Secretary Geithner said he will take extraordinary measures to stave off US default in early 2013 whilst a deal is worked out on the fiscal cliff and debt ceiling. On the latter, measures taken will push theoretical limit to about early March. USD modestly weaker.

- AUD: Stable after recent softening on the back of a reduced likelihood of a fiscal cliff deal in the US. This has produced a series of higher lows over recent sessions, but tone still consolidative around 1.0360 area.