The final tally was Macron 23.75%, Le Pen 21.53% and to say markets are relieved would be an understatement.

One peculiar thing is that it seems completely lost on everyone that Marine Le Pen did indeed make the second round. So it’s not exactly like populism just fell flat in Sunday’s vote. Rather, the enthusiasm seems to stem from the fact that polling is “great again.†Apparently, Brexit and Trump didn’t completely antiquate the pollsters and their methods and if that holds, then Macron will become President. Here’s how one former FX trader put it earlier this morning:

The pollsters won the first round of the French presidential election. In other news, Emmanuel Macron and Marine Le Pen have advanced to the next phase. There were times last night when there seemed to be as much relief from the forecasts being accurate as the diminished likelihood that one of the extremists will win the ultimate prize.

Truer words have yet to be spoken about this election.

Ultimately, the second round will be a fight between nationalism and globalism and by all accounts, the globalists will easily carry the day.

As tipped here on Sunday evening, that’s being reflected across markets – and ‘bigly.’

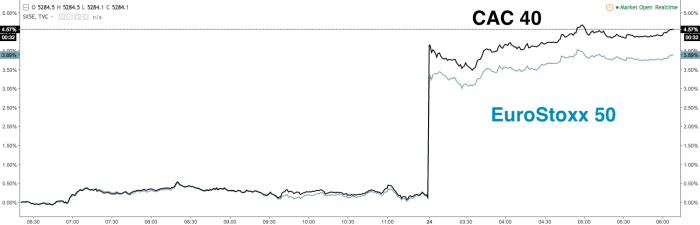

Eurozone stocks are surging, especially the CAC 40 which is up more than 4%…

The euro is up sharply…

The yen is the loser as investors dump havens…

French yields are falling as investors dump safe-haven bunds…

Which means the OAT-bund spread has come in materially and swap spreads collapsed across the curve…

The EUR/USD rally was supported by macro and leveraged names that were not sufficiently exposed to euro upside and have thus been fading the dip off the open, two traders in Europe said. “EUR also supported by unwinds of bearish option trades expiring shortly after the second round of French elections,†Bloomberg goes on to note. Meanwhile, “implied vols in euro pairs are sharply lower as risk reversals erase French election risk premium [but] profit taking and CTA selling are capping gains for the time being, other traders said a few hours ago. Yen losses were capped by geopolitical tension.