You might not think a movie about robbing banks illuminates some of the fundamentals of value investing, but then again, you might not have seen Hell or High Water. The movie tells the story of two brothers who traveled around rural Texas robbing small town banks early in the morning to keep their family property out of foreclosure. It’s not about the intricacies of their heist, it’s the simplicity of the smaller banks they robbed. It’s only when they got greedy, going after a bigger bank, that they got caught.

We think of Charlie Munger, the Vice-Chairman of Berkshire Hathaway, who taught us that “competition is the enemy of competence.†You see, while the brothers successfully found no competition in the smaller rural banks, they ran into trouble when attempting to rob a busy bank later in the day with customers who all had their own guns. They had lost their gun-powered moat.

There is a very important investing lesson in these bank robbing efforts. When the brothers were the only holders of a weapon in the early bank robberies, their enterprise was lucrative. You might say they were in “High Water.†When they attempted to rob a larger and busier bank later in the day, their fire power was overwhelmed by weapons in the hands of law abiding citizens. Charlie Munger would say their “Hell†came from too much competition as their competence disappeared.

Do profitable businesses exist today which face little or no competition?

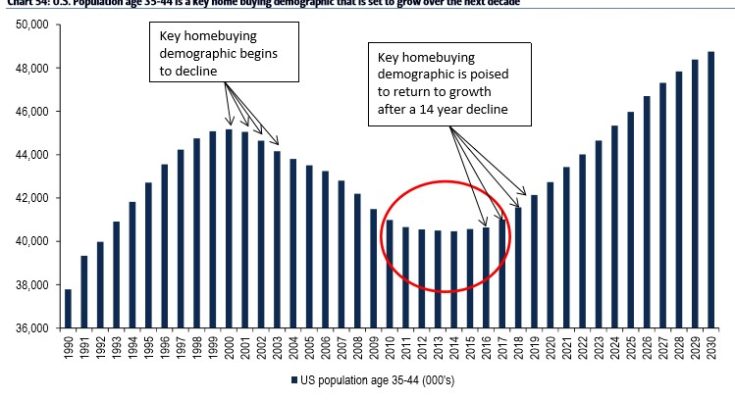

Aflac (AFL) is the largest seller of supplemental health insurance in the U.S. As Yogi Berra said at the barbershop in an Aflac commercial, “If you get hurt and miss work, you won’t be sick because you missed work.†Typically, folks aren’t attracted to supplemental health insurance until they have their first child. We believe the demographics shown below scream for a great market in health insurance sales for Aflac over the next fifteen years1: