Image: Bigstock

Image: Bigstock

Powell’s Hawkish Comments Shake Equities

Ten days after the election, the sugar high and animal spirits appeared to be finally wearing off. Tech stocks and the Nasdaq 100 Index ETF ( – ) finally encountered some heavy selling pressure on Friday after comments from Federal Reserve Chairman Jerome Powell earlier in the week.Powell said, “The economy is not sending signals that U.S. central bank needs to be in a hurry to lower interest rates.” Investors must understand that markets are often driven by liquidity, especially from the Federal Reserve. Nonetheless, considering the roaring rally seen since the presidential election, Powell taking the foot off the dovish gas pedal is not surprising. With stocks up 5% last week, some profit-taking is to be expected.Presented below are five more reasons stocks will likely find support.

1. Technical Confluence Zone

The price action shown below illustrates that the QQQ ETF has been retreating to a high-probability buy zone, which includes a retest of the breakout and the $500 figure, a daily price gap fill, and the rising 50-day moving average. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

2. OPEX

It should be noted that Friday is options expiration. Often, stocks trade a bit oddly on options expiration days as traders move to reposition.

3. Healthy Breadth Under the Hood

The major indices can sometimes tell a partial story regarding market health. In order to get the full story, market participants must check breadth (participation).Though the major indices faded hard, only ~60% of stocks were lower for Friday’s trading session. Though the markets were down, leading stocks like Tesla ( – ), Coinbase ( – ), MicroStrategy ( – ), and Root ( – ) were up.

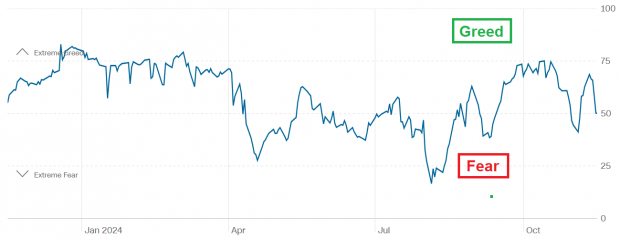

4. Dramatic Sentiment Shift

This week, the “CNN Fear & Greed” indicator showed that sentiment plunged from “Greed” to “Neutral” levels. Savvy investors can often use sentiment as a contrarian indicator. Image Source: CNN

Image Source: CNN

5. Seasonality

Historical seasonality suggests that markets tend to retreat into Thanksgiving week before rallying into year-end.

Bottom Line

Friday’s market swoon may seem intimidating on the surface. Nevertheless, several pieces of evidence, including the QQQ chart, sentiment, and seasonality, all seem to suggest that the downside will be limited.More By This Author:5 Reasons To Be Bullish In Q4 Bear Of The Day: Nike3 Stock Trends To Ride In 2025 And Beyond

Hawkish Powell Shakes Stocks: What’s Ahead?