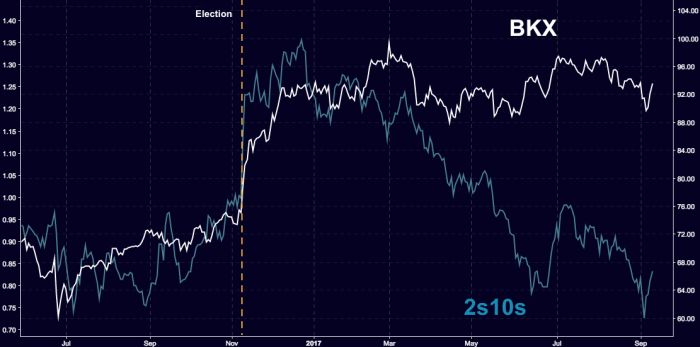

In a world where virtually every so-called “Trump trade†has been faded as the market prices out the prospects for the administration’s agenda, banks have held up reasonably well. Especially when you plot them against the collapsing yield curve:

Basically, investors think regulatory reform and tax cuts are still in the cards and the prospect of shareholder returns post CCAR helps sentiment as well.

Still, it would be difficult to describe the mood around financials as ebullient. They’ve gone sideways since January and as Goldman’s Katherine Fogertey and John Marshall write in a note dated Tuesday, “the Trump premium has drained out of banks.â€

Based on their model, banks have gone from outperforming their “normal†relationship with macro assets by a full 12% in the immediate aftermath of the election (the “Trump bumpâ€) to underperforming the same model by 4%:

“This latest underperformance in Banks (BKX) vs macro assets is evidence that investors are pricing a very low probability of significant regulatory or tax reform,†Marshall and Fogertey write.

But for the enterprising among you, that probably means there’s some upside asymmetry here. Just know that if you take that trade, you’re effectively betting that Gary Cohn won’t ultimately leave the administration – either of his own accord, or by orange-faced decree.