Tuesday’s session started off on the back foot, with the Euro first sliding on Draghi’s dovish comments before Europarliament on Monday where he signaled no imminent change to ECB’s forward guidance coupled with a Bild report late on Monday according to which Greece was prepared to forego its next debt payment if not relief is offered by creditors, pushing European stocks lower as much as -0.6%. However the initial weakness reversed after Greece’s Tzanakopoulos denied the Bild report, sending the Euro and European bank stocks higher from session lows. S&P futures are fractionally lower, down 3 points to 2,410.

Elsewhere, the Japanese yen rallied after strong retail sales data while US Treasuries ground higher after returning from a long weekend largely unchanged; Australian government bonds extend recent gains as 10-year yield falls as much as four basis points to 2.37%. Asian stock markets and were modestly lower; Nikkei closed unchanged despite a stronger yen. China and Hong Kong remained closed for holidays while WTI crude was little changed.

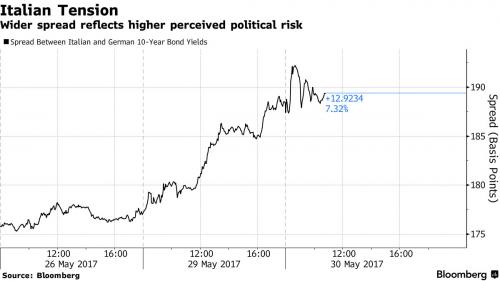

Despite the rebound, the Stoxx Europe 600 Index declined a fourth day as data showed that contrary to expectations of a record print, euro-area economic confidence fell for the first time this year, and as Draghi’s dovish comments to the European Parliament weighed on banking shares. As discussed yesterday, Italian bonds edged lower as traders digest the prospect of an earlier-than-expected election.

As Bloomberg politely explained, the overnight pullback across several assets serves as a reminder that, while equity benchmarks across the world have posted repeated records this year, potential headwinds to the global growth story remain and investor concern lingers. Or, in other words, selling is still not illegal. Elections in the U.K., Germany and Italy are looming as Brexit negotiations begin, while in the U.S. President Donald Trump’s ability to implement spending and tax-cut plans is far from certain. Speaking on Tuesday, St. Louis Fed President James Bullard said the new administration will need to fulfill the expectations that have driven the stock market higher, unless of course, the same Bullard suggests that QE4 is on the table next in which case the market will rise even higher.

“Washington does have to deliver at some point,†Bullard said in an interview on Bloomberg TV in Tokyo. “That is a concern going forward, whether the honeymoon period would end at some point and maybe the reality of American politics would settle in.â€

Looking at global markets, Japanese stocks ended higher despite a stronger yen, with the Topix reversing earlier losses. Data showed Japan’s jobless rate stayed at the lowest in more than two decades last month, but household spending remained in a slump while retail sales came in stronger than expected. Hong Kong and China markets were shut for a holiday.

The Stoxx Europe 600 Index declined 0.2 percent. Futures on the S&P 500 Index fell 2 points, or 0.1%, to 2,411. The S&P cash index closed at a new record high on Friday.

In currencies, the euro traded little changed at $1.1167 as of 6:16 a.m. in New York. The British pound added 0.2 percent. The Bloomberg Dollar Spot Index was little changed. The yen strengthened 0.2 percent to 111.06 per dollar. The rand retreated 0.9 percent, extending losses for a second session after President Jacob Zuma survived a bid by some members of his party to oust him.

Accross commodities, West Texas oil dipped back under $50, falling 0.6% to $49.52 per barrel; prices swung last week following the agreement by OPEC and its allies to extend cuts by nine months.

On the U.S. calendar, we get personal spending, personal income, consumer confidence, Dallas Fed index, S&P/Case-Shiller home price, but according to SocGen, “today’s data will all be forgotten by the end of the week, with US ISM on Thursday and the labour market report on Friday more likely to stick in memories.”

Market Wrap

- S&P 500 futures down 0.1% at 2,411

- Nikkei 19,677.8, down 0.02%

- Stoxx 600 390.36, -0.24%

- Equities: CAC 40 (-0.9%), FTSEMIB (-0.8%)

- WTI $49.50, down 0.6%

- Brent futures down 0.8% to $51.87/bbl

- Gold spot down 0.2% to $1,265.10

- U.S. Dollar Index up 0.1% to 97.54

Bulletin Headline Summary from RanSquawk

- European equities enter the North American crossover modestly lower as UK and US return to market

- Risk drivers minimal from what we can evaluate, with the Greek payment opt-out story prompting modest flow out of EUR/JPY, and pulling USD/JPY below 111.00 as a result.

- Looking ahead, highlights include German regional & national CPIs, US Personal Spending, PCE data

Top Overnight News from Bloomberg

- Federal Reserve Bank of St. Louis President James Bullard said that at some point the honeymoon period will come to an end and Washington will need to deliver on the policy expectations that have driven the stock market higher

- Federal Reserve Bank of San Francisco President John Williams sees a “much smaller†Fed balance sheet in about five years, at the end of an unwinding process that could start with a “baby step†later this year

- First Data Corp. said it will buy CardConnect Corp. for $750 million, in what CEO Frank Bisignano called his company’s biggest acquisition since 2004

- Citigroup Inc. agreed to sell its fixed-income analytics and index business to London Stock Exchange Group Plc for $685 million in cash following a strategic review of the unit

- Goldman Sachs Group Inc. was denounced by the head of Venezuela’s legislature over a report that the bank bought $2.8 billion of bonds from that country, potentially helping President Nicolas Maduro’s administration amid accusations of human-rights violations

- Euro-area economic confidence fell for the first time this year, led by weaker readings in the services and retail sectors

- Akzo Nobel NV successfully dodged a legal challenge by activist shareholder Elliott Management Corp. to oust Chairman Antony Burgmans, strengthening the Dutch paintmaker’s hand in rebuffing takeover talks with a U.S. suitor