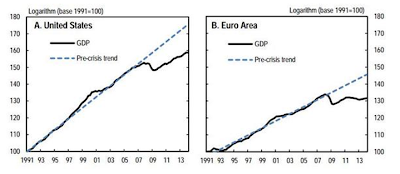

This Great Graphic was tweeted by the Financial Acrobat.  The charts show US and euro area GDP in log charts that also plot the pre-crisis trend.

This Great Graphic was tweeted by the Financial Acrobat.  The charts show US and euro area GDP in log charts that also plot the pre-crisis trend.

It is clear that the crisis has thrown the US off its prior path, but it now appears to be on a parallel path, that is lower. Â

Growth in the euro area has also broken down. It has yet to initiate a new expansion trend, which is in part, why some do think that it has not really and truly exited its recession.Â

One of the big macro views that has shaped the debate in recent months is the resurrection of the previously discredited “secular stagnation” hypothesis by Lawrence Summers. The concept was first proposed by Alvin Hansen in the 1930s. It died an ignoble death as the US (and world) entered a long expansion wave. Marxists, like Magdoff and Sweezy tried reanimating the theory in the late 1980s, but offered a considerably nuanced view.  Â

Magdoff and Sweezy generally argued that while mature capitalism was prone to stagnation, there were a number of mitigating factors, like government spending and permanent government deficits. In an essay published in the early 1980s, Sweezy wrote: “Does this mean that I am arguing or implying that stagnation has become a permanent state of affairs? Not at all.”

Looking at chart on the left, the idea of secular stagnation in the US does not come to mind.  The slope of the GDP in the euro area is not as steep as the US prior to the crisis and the economy appears to have gone no where in the last 6-7 years. Does this qualify as secular stagnation? Â