In a normal review of the US, the IMF recently called on the Federal Reserve to drop its dot-plot tool and replace it with a single staff forecast, like the ECB. We too have been critical of the individual macroeconomic forecasts and appropriate level of Fed funds. We think it is a particularly noisy channel of Fed communication.

There seems to be more salient issues for the IMF to focus on than the Fed’s communication.When everything is said and done, the Fed’s communication seems fairly clear. There would be a period of time between the completion of its asset purchases (QE) and the first hike in the Fed funds target range. It has gradually shifted from date-specific to data-dependent policy. It has warned anyone who wishes to listen that it intends to raise rates this year provided that the slack in the labor market continues to be absorbed, and that officials can be “reasonably” confident that the inflation target will be met in medium term.

The Federal Reserve has not surprised the market. It has telegraphed its major step months in advance. Last month’s dot plots showed that a majority of the Fed still think that two rate hikes this year may be appropriate. Surely few can really claim surprise if the Fed were to hike rates in September. The market understands what the Fed is signaling but is skeptical. The pricing of Fed funds futures market suggest a single hike at the December meeting is the odds on favorite scenario in the market (as opposed to surveys, which continue to show a majority of economists expect a September move)

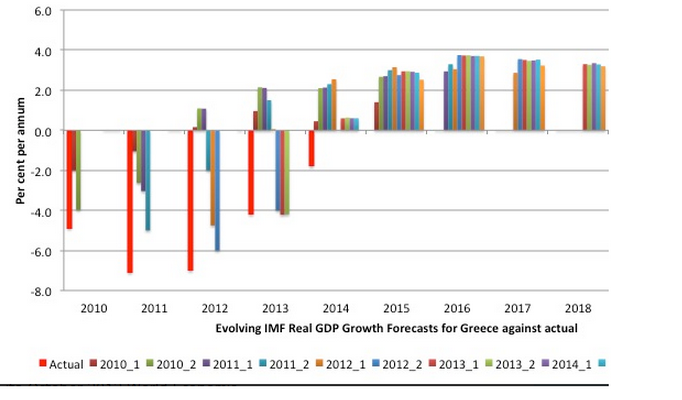

The IMF suggests that a single staff forecast should be introduced to replace the dot-plots. Is this such a good idea? Look at this Great Graphic from Billy Mitchell–billy blog. It shows the evolving IMF forecasts for Greek GDP for the last several years. It is habitually more optimistic that the actual performance (red bar). This is true even after it admitted ( circa 2012) that it under-estimated the fiscal multiplier (how much austerity would depress the economy).