The Federal Reserve meets in a month. We all can appreciate that one of the most important elements is expectations. How should investors measure expectations?

We can take a page from the Fed’s playbook itself. It has identified two ways to measure inflation expectations. There are market measures, like the spread between inflation-linked bonds and conventional bonds, or break-evens. In addition, there are surveys, like the University of Michigan’s survey that ask respondents specifically the rate of inflation they expected in both the short and long-terms.

The Federal Reserve has placed more emphasis on surveys, which show inflation expectations remain anchored. The market-based measures have softened.

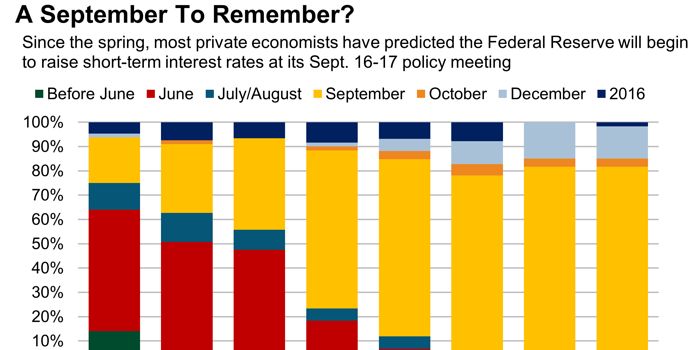

Similarly, there are survey and market-based measures of expectations for Fed policy. The Great Graphic here is the results of the monthly Wall Street Journal survey. The survey for the most recent bar was conducted following last week’s employment report. There are also market-based measures such as the Fed funds futures and the Overnight Index Swaps (OIS).

There is a similar discrepancy between the measures of Fed expectations as there is with inflation expectations. The WSJ survey shows high expectations for a hike next month while market-based measures show less conviction.

The Wall Street Journal survey of 60 business and academic economists found 82% expect a hike next month. This is unchanged from July’s survey and up 10 percentage points from June. A December hike is thought more likely by 13% of the respondents, down from 15% in the July survey. Only one economist thought the Fed would wait until next year to hike rates.

Interestingly, the survey found that 69% of economists thought that the risk was that the Fed would wait too long to raise rates. The others (31%) thought the risk was that the Fed would move too soon. The split last month was 71% to 29%.

Market-based measures are considerably less convinced. The September Fed funds futures contract is pricing in a little less than a 60% chance of a hike. Some assumptions have to be made, and the different assessments reflect these different assumptions. The contract settles at the average effective Fed funds rate for the month. Unlike in the past, the current policy targets not a fixed level of Fed funds, but a range. Currently, that range is 0-25 bp and the effective Fed funds rate has averaged 13 bp over the past 100 days. Note that the Fed funds effective rate on Fridays, also count for Saturday and Sunday. This month the effective Fed funds rate has averaged 14 bp and this week it has ticked up to 15 bp, which incidentally is the highest since Q1 13.