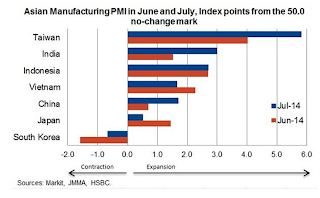

It is the beginning of the month and a new data cycle. It starts with manufacturing PMI reports. ThisGreat Graphic was tweeted by Markit, but also draws on data from Japan’s Materials Management Association and HSBC.Â

Taiwan’s activity has accelerated markedly.  India’s manufacturing sector has improved as well, and it appears to be outpacing China, where the manufacturing PMI is at its best level since April 2012.

Early this week, Japan reported a 3.3% decline in June industrial production. This was a surprise for the market where the consensus had forecast a 1.2% decline. In June the Markit/JMMA manufacturing index stood at 50.8. In July it has slipped to 50.5. The government’s industrial production report includes a survey of expectations for the following month’s report. Japanese producers expect output bounced back in July.Â

Of the select Asian countries included in the Market chart here, South Korea is the only country where the manufacturing PMI is below the 50 boom/bust level. In June when the HSBC manufacturing PMI stood fell to 48.4 from 49.5, industrial output rose 2.9% (seasonally adjusted month–over-month), which was more than twice the gain the market had expected.  Â

Along with the July PMI, South Korea also reported July trade figures today. Exports, on a year-over-year basis more than doubled from 2.5% in June to 5.7% in July. The Bloomberg consensus forecast was for a 3.8% gain. Imports have risen 5.8% over the past 12 months. The Bloomberg consensus was for a 1.5% rise after 4.5% in June. The resulted in a smaller than expected trade surplus, but seems to reflect stronger domestic and foreign demand, suggesting goods producing sector may not be as weak as the PMI suggests.

On the other hand, headline inflation eased in July to 1.6% from 1.7%. The core rate though first to 2.2% from 2.1%. Recall that when the central bank meet in early July, it left its 7-day repo rate steady at 2.5%. There was one vote in favor of a cut. The central bank meets on August 13.  There are beginning to be some market calls for a rate cut, but August may be too soon.Â