International REITs could be a valuable option for investors interested in diversifying their portfolios. And, investors do not have to settle for lower-quality assets or lower dividend yields from REITs based outside the U.S.

One example is Granite Real Estate Investment Trust (GRP-U), a REIT based in Canada. Not only does Granite have a strong business model, but it also pays a hefty 5.0% dividend yield. It is one of 416 stocks with a 5%+ dividend yield.

Furthermore, Granite pays its dividend monthly, which is a more attractive dividend schedule than most U.S. REITs, which typically pay quarterly dividends. Granite is one of only 29 stocks with a monthly dividend. Granite is in the middle of a contested battle with activist investors, which could alter the company’s growth strategy moving forward.

This article will discuss Granite’s business model, and its merits as a dividend stock.

Business Overview

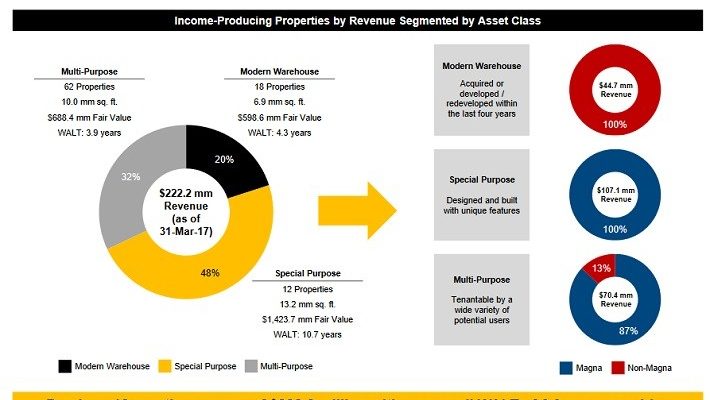

Granite owns and manages predominantly industrial real estate properties, in North America and Europe. It converted to a REIT on January 3, 2013, and has transformed itself into a leaner, more efficient company, with higher-quality assets.

The company’s income-producing portfolio consist of Multi-purpose, Logistics and Distribution Warehouses, and Special-purpose facilities.

Â

Source:Â May 2017 Investor Presentation, page 16

This is a tumultuous time for Granite, but not because of any deterioration in the fundamentals of the business. Rather, activist investors have purchased a significant stake in Granite, and are pushing for a major shake-up that management believes to be dangerous for the company.

Activist investor FrontFour Capital Group, along with private-equity firm Sandpiper Asset Management, combined own 6% of Granite, and have pushed for changes to the company’s Board of Directors. In addition, the investors believe there is significant potential for Granite to unlock shareholder value by leveraging its balance sheet to pursue an acquisition or increase share buybacks. Existing management does not view the investors’ proposals favorably. Granite management believes the investors want the company to make acquisitions of lower-quality assets, which will ultimately lead to destruction of value over time.