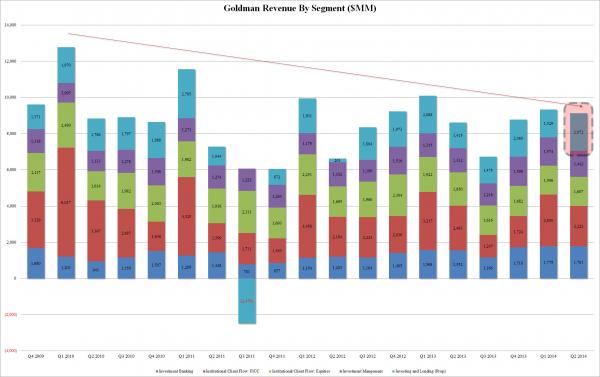

Moments ago Goldman Sachs surprised Wall Street by trouncing expectations of a $3.09 EPS print with a beat over $1, printing at $4.10, coupled with a surge in revenue which declined from Q1’s $9.3 billion by far less than consensus (Est. $7.98 billion) had expected, printing at $9.125 billion. What drove this? Clearly not a pick up in trading volumes: FICC declined 10% Y/Y and 22% from a quarter ago, while total Institutional Client Services dropped 11% Y/Y. Investment Banking did pick up modestly, up 15% from last year’s $1.552 billion to $1.781 billion but this too did not explain the difference. The answer:Â Goldman’s prop trading group is baaaaack.

With total revenue for the “Investment and Lending” group, aka “Prop”, this was a whopping 46% surge in revenue Y/Y and up 36% from past quarter. In fact, Q2’s prop trading revenue was the highest since Q1 of 2011! Putting this in context: the Goldman prop trading revenue in Q2 was the second highest since Lehman, lower only than the $2.705 billion in Q1 2011. Rest in piece Volcker Rule.

Â

Surely, the fact that Goldman repurchased $1.25 billion of its stock didn’t hurt the bottom line either.

As a result, average Goldman comp rose from $376,840 to $385,988: the highest since Q2 2013.

Â

A great job well done, FDIC-insured hedge fund traders!