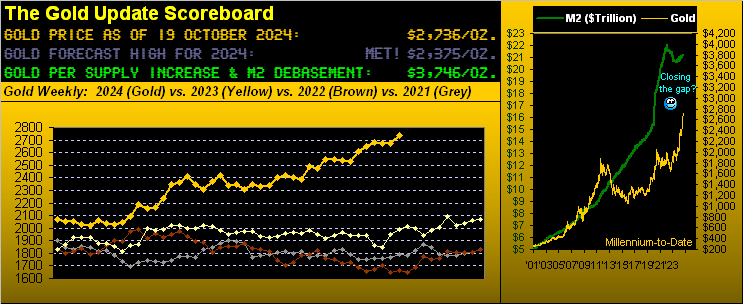

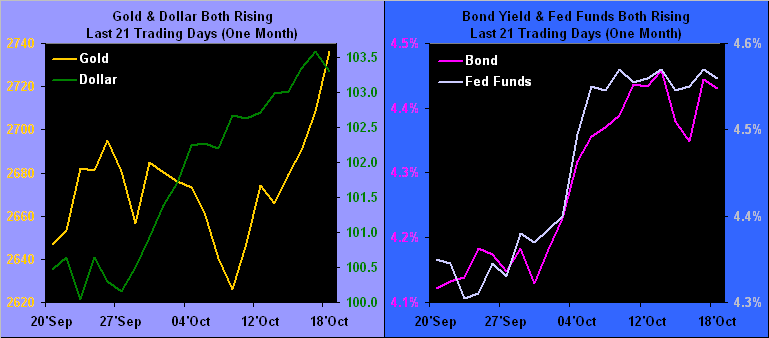

‘Tis simple really. Against all conventional wisdom (to the extent that any wisdom whatsoever remains as The Investing Age of Stoopid rolls merrily along), Gold is merely yet again proving — as on occasion is its wont — that it plays no currency favourites.Too, ’tis great having returned following our travels amongst the wilds of easternmost England, to now be ensconced in the quiet confines of our otherwise palatial estate. However, it does beg the pro-Gold question: ought we perhaps travel more often? For in the wake of last week’s brief “in-motion” missive “Gold in 60 Seconds (III)”, the yellow metal went on to record a series of fresh All-Time Highs, reaching yesterday (Friday) up to 2738 before settling at 2736. And note the suggestion of Gold en route to closing the gap from its Dollar debasement value in the above Scoreboard’s right-hand panel. Just an observance… “But it’s not about you, mmb, so may we stick to the issues?“Of course, Squire, duly noting our having been out-of-pocket without your skillful support last Saturday was a challenge.But on with the show, beginning with the following two-panel graphic depicting several series of what are more usually Gold-negatively-correlated entities across the past 21 trading days. On the leftwe’ve Gold from 20 September through 19 October along with the independently-scaled Dollar Index:and yes, Virginia, as we’ve seen in the past, both Gold and the Dollar have been on the rise. On the rightfor the same one-month stint we’ve the annualized yield of the U.S. 30-year Treasury Bond and the FedFundsFutures equivalent rate, also both on the rise.Naturally, axiomatic fanatics argue this can’t occur, but (in again cuing Tag Team from ’93) “Whoomp! (There It Is)”:(Click on image to enlarge)

‘Course, with Gold on the rise and also the Dollar and also yields, ’tis a no-brainer that equities must be in “Dire Straits” … however “Why Worry” (’85): for the S&P 500 set another record high (5878) this past Thursday, the “live” price/earnings ratio settling the week at 43.7x, +72% above its inception a dozen years ago. But as we’ve been stating time and again, earnings no long matter, (see the S&P 500 from 24 March 2000 through 10 October 2002).“But obviously, mmb, the market always goes all the way back up and as you say, ‘beyond’, eh?“Squire, throughout the 67-year history of the S&P 500, that has ultimately been the case. But in this current age of the “low-information, short-attention span, instant gratification crowd“, patience would be vapid in weathering a 13-year, double-dip S&P 500 trough for a price gain of just 2% as we witnessed following 24 March 2000 until 10 April 2013. It happens.But let’s go to what truly of late has been “The Happening” (The Supremes, ’67): by yesterday’s 2736 settle, Gold year-to-date is now +32%, second only to the BEGOS Market component Silver, she now +41%! Indeed, the white metal’s long-overdue “catching up” is in play to some extent, the Gold/Silver ratio — as below noted at the foot of Gold’s weekly bars graphic — having been reduced this past week to now 80.7x, its lowest reading since 16 July, (but still well above the century-to-date average of 68.5x). Thus with Gold remaining very cheap relative to currency debasement — and Silver still a bargain relative to Gold — here is the yellow metal from one year ago-to-date:

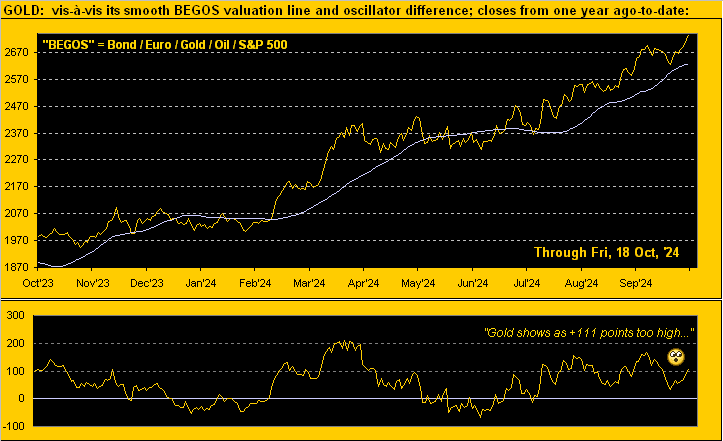

With a justifiable nod toward Gold jubilation and its still being ever so cheap from the long-term currency debasement perspective, as has been our prudent point of late:Gold near-term remains “high” relative to its BEGOS valuation.So again we next display Gold’s daily closes from one year ago-to-date astride its smooth valuation line — itself rightly rising — but suggesting price “ought be” (per the lower panel oscillator) some -111 points lower at 2625.To be sure, ’tis a one-off valuation for Gold given its price movement relative to those of the other four primary BEGOS Markets; but obviously price and valuation inevitably meet … just in case you’re scoring at home:(Click on image to enlarge)

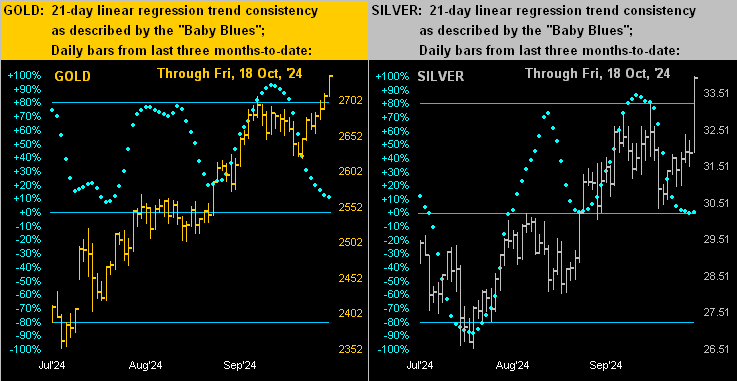

Now this next graphic comes with a loss of words to substantively describe, if for no other reason than ’tis perfection for the daily bars across the past three months-to-date featuring Gold on the left and Silver on the right.As noted, the yellow metal is at a record closing high of 2736, whilst the white metal at 33.93 is at its best daily settle since 29 November 2012.Nuff said:(Click on image to enlarge)

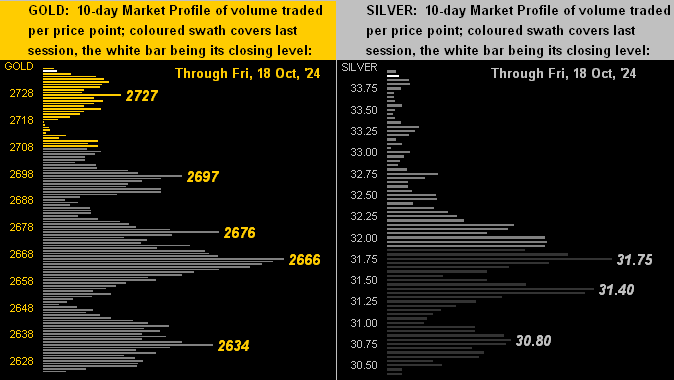

And thus segueing to the precious metals’ 10-day Market Profiles, it stands to reason that we find both Gold (below left) and Silver (below right) essentially at the top of their respective stacks, notable underlying volume-supportive prices as labeled:

Towards this week’s wrap, with The Washington Post opining that the 2024 StateSide economy may be amongst the best of our lives, we indeed turn to the Economic Barometer.Of the 14 metrics taken in by the Econ Baro this past week, six improved period-over-period … meaning that eight did not improve.The week’s notable winner was substantive growth in the pace of Retail Sales for September. But amongst the stinkers came shrinkage in September’s Industrial Production from August’s +0.3% to -0.3% and a like erosion in the New York State Empire Index from +11.5 in September to -11.9 for October. Still, “WaPo” says ’tis all on go. Do you think so? Here’s the Baro:

So “What’s UP?” indeed!With Gold and the Dollar and Yields and even the stock market all on the rise, might we be facing a Fed surprise?After all, as aforeshown, the rate equivalent of FedFundsFutures also is up of late. The Federal Reserve’s Open Market Committee issues its next Policy Statement on 07 November … which is a Thursday!Why not on the usual Wednesday?One guess may be that “they” (whoever “they” are out there) still shan’t have “declared” the winner of the Tuesday, 05 November Presidential Election. “Well, there’s millions of mail-in ballots still to count, ya know…”And of course ’tis The President who nominates the FedHead.So might it behoove one to see who’s won before the next Fed policy is spun, lest it all come undone?For in speaking of spin, hat-tip “Political Calculations” with this gem: And keep your hat tipped to Gold as THE gem!More By This Author:

And keep your hat tipped to Gold as THE gem!More By This Author:

Gold Up; Dollar Up; Yields Up – What’s Up