Gold prices ended Wednesday’s session up $7.28 as the dollar weakened after the minutes of the Federal Reserve’s latest policy meeting showed some central bankers were watching for evidence that a recent economic slowdown is temporary before committing to another interest rate hike. The minutes, which were released Wednesday afternoon, also revealed that most participants believed they should raise interest rates if economic information came in about in line with their expectations.

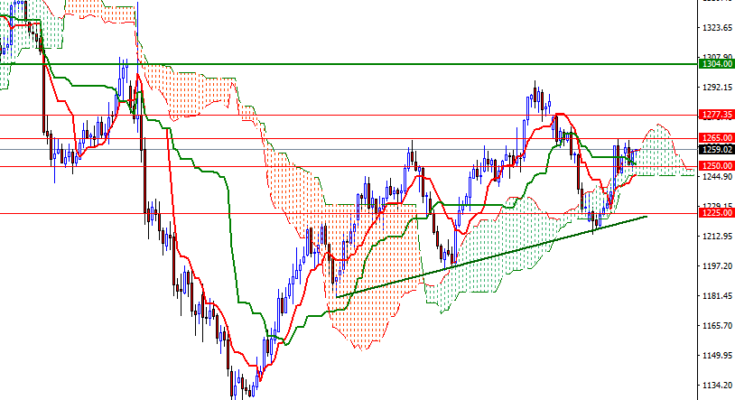

From a chart perspective, the bulls have the near-term technical advantage. XAU/USD climbed back above the Ichimoku clouds on the H1 and the M30 charts yesterday. In addition to that, the daily and the 4-hourly clouds continues to be supportive. Despite this positive outlook, beware that the market is still trapped in the trading range of the past five sessions (1265-1245).

The bulls have to convincingly push the market above the 1265 level, the confluence of a horizontal resistance and the top of the weekly cloud, if they intend to challenge the bears on the 1271.50-1269 battlefield. Closing above 1271.50 implies that 1277.35-1276 will be the next target. The clouds on the H1 and the M30 time frames overlap in the 1256/3 area, so the bears will need to drag prices below there to challenge the support at 1250. If this support gives way, it is likely that the XAU/USD will test 1245.