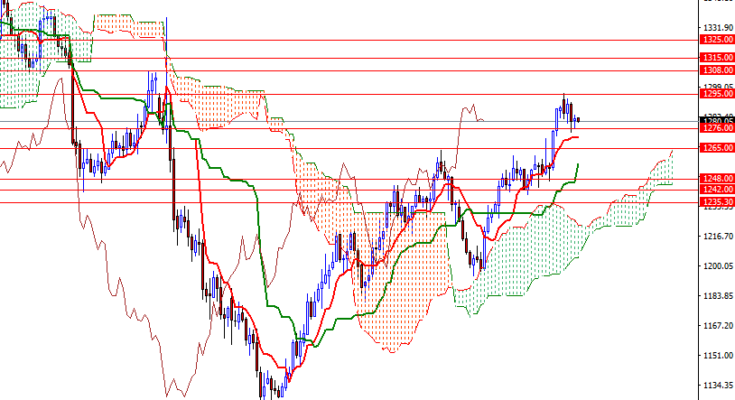

Gold prices ended slightly higher on Thursday but the trading range was relatively tight as investors took a cautious stance ahead of France’s closely watched presidential election. The XAU/USD pair swung between the $1283.35 and $1276.62 levels. The market is trading above the Ichimoku clouds on the daily and the 4-hourly charts, indicating that bulls have the overall medium-term technical advantage.

However, prices are still below the clouds on the H1 time frame and the intra-day resistance at 1283.40 remains intact. Flat Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on the H4 and the H1 charts shows that there is a lack of strong momentum.

To the downside, keep an eye on the 1277.35-1276 area. Falling through this support could pull the market back to the 1265 level. In that case, expect to see some support at 1272 and 1269. Bulls will have to push prices above the 1283.40 level (i.e. pass through the hourly cloud) so that they can make a move towards the 1289/7 zone. Beyond there, bears will be waiting in the 1295/2 region.

Â